Easy, smart and safe. Maybank's newest lifestyle and payments app, M2U SG (Lite), is here to help you level up your money management skills and boost your financial habits.

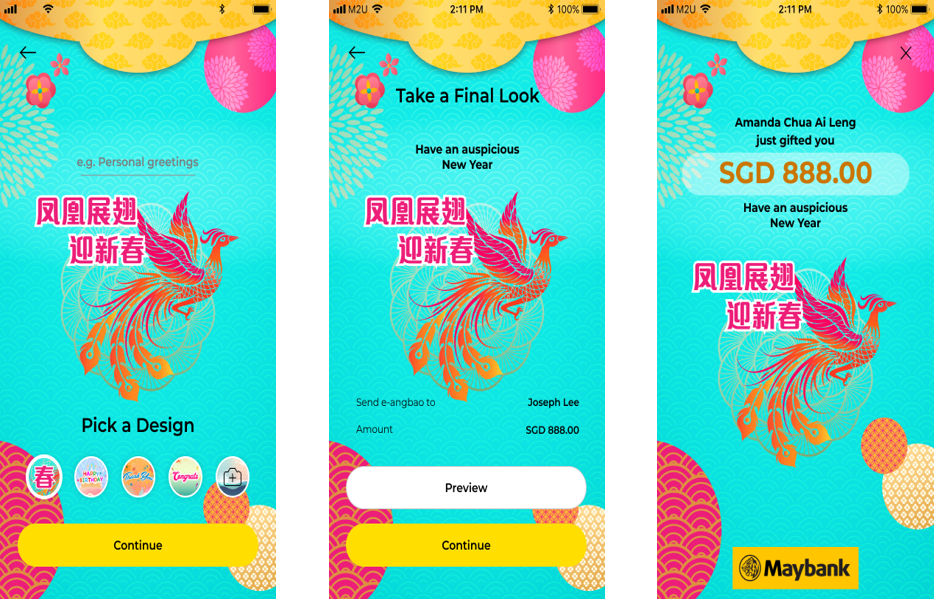

As a symbol of good luck and happiness in the Chinese culture, angbaos, or red packets, have long been given out during auspicious occasions such as weddings and Chinese New Year as tokens of blessing.

In the Song Dynasty in the 12th century, people used to wrap money in red silk or cloth packets, before this evolved into the red paper packets we are more used to seeing today, and increasingly, e-angbaos.

Whatever format they come in, the significance of the angbao remains unchanged. With technology, even with the pandemic, it is possible for our festivities and celebrations to go on.

Digital and environmentally friendly, Maybank’s latest ‘Maybank2u SG (Lite)’ mobile banking app, or simply called ‘M2U SG (Lite)’, is downloadable from Apple App Store and Google Play from 20 January 2022 onwards. It offers eye-catching e-angbaos that can be customised with your own message and photo.

Your virtual personalised financial assistant

The e-angbao phenomenon is an indication of a bigger shift in our lives - how we are digitalising the way we deal with money.

More than just a platform to send and receive e-angbaos, M2U SG (Lite) app serves as your personalised financial assistant - the only mobile app you need for all your day-to-day banking needs.

The new app comes with new, personalised and easy-to-use features that are complementary to the existing M2U SG mobile app so you can stay in control of your finances. Here’s how:

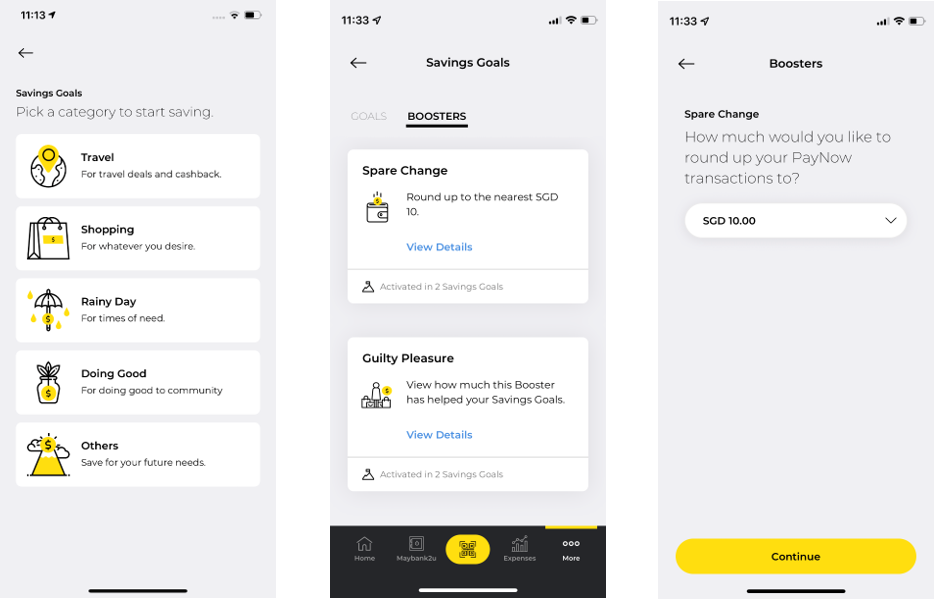

1. Achieve your goals

Whether you’ve been eyeing the latest iPhone, a Maldives getaway or an apartment to call your own, saving is a key step to achieving that goal - and M2U SG (Lite) can help you with that.

The Savings Goals feature on the app allows you to create specific savings goals, such as for Travel, Shopping, Rainy Day, Doing Good or Others. By earmarking or setting aside a target sum to be drawn from a linked iSavvy account over a certain specific period, the app will track your progress towards your goal in real-time.

Speed up your savings with these boosters:

• Enable the Spare Change booster, which rounds off PayNow transactions towards the goal to the nearest S$1 or S$10 per your selection and adds that to the specified goal, which will incentivise you to save more than intended.

• The Guilty Pleasure booster encourages you to stick to your savings goals by setting a monthly limit for each expenses category. When your spend exceeds that limit, a pre-determined sum will be added to the specified goal, converting your spending habits into savings.

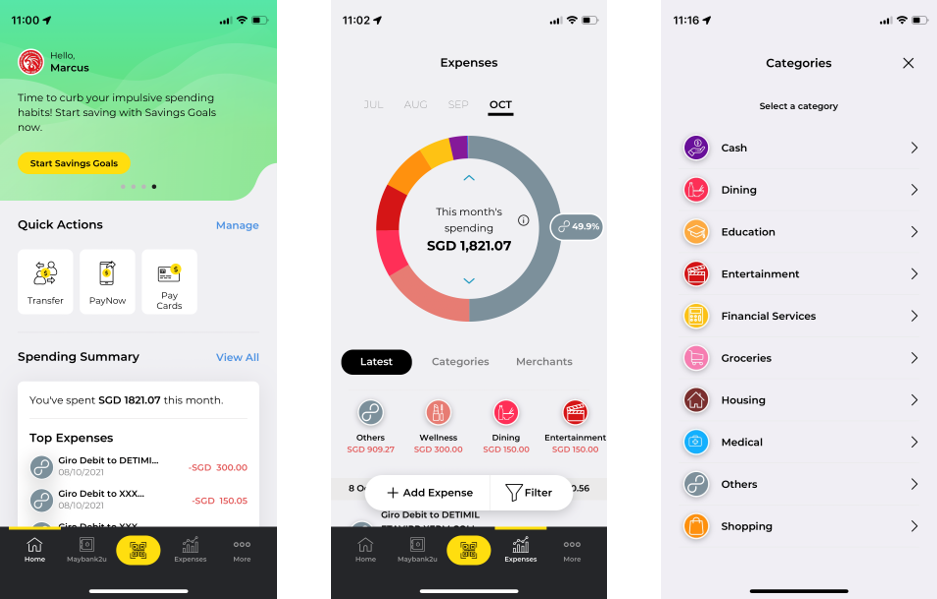

2. Sort out your spending

Track all your expenses - from PayNow and fund transfers to debit and credit card usage - with greater ease. You can key in expenses from other bank accounts for a more comprehensive view of your money too.

More importantly, understand your own spending habits so that you can better manage your money. With M2U SG (Lite), you can organise your transactions by date, different categories, offline/online purchases, or even merchant.

This means getting a bird’s eye view of your money with easy-to-read data, such as your daily average spending, your total expenses over 12 months and your top three spends each month.

3. Your personal advisor

We all know it is good to be prudent and prepared when it comes to money matters. But it can be difficult to get started or to stay on track.

With the Moments feature, M2U SG (Lite) looks out for you. For example, each time you open the app, you will be greeted with a useful and actionable titbit or insight based on your unique lifestyle and transaction patterns, such as reminders to categorise your expenses so you can stay organised.

M2U will also prompt you to build an emergency fund if it doesn’t detect any so that you can be better equipped to deal with financial emergencies if they do crop up.

Leave it to M2U SG (Lite)

With this app, it’s about being fully attuned to your money needs and taking care of them the smart way, whether it has to do with tracking expenses in detail or improving your financial habits in the long run.

And ultimately, it’s about putting you in greater control of your finances.

the bottom line:

Do more with less by using Maybank2u SG (Lite), the only app you need to manage your money easily, seamlessly, and safely, with a personal touch.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram