As a key recipient of investment flows from China, ASEAN is likely to see a rebound in Belt and Road Initiative (BRI) projects this year as the Chinese economy re-opens. The quality, focus and size of these investments will be closely watched as China recalibrates its BRI focus towards more environmentally sustainable projects with stronger risk controls.

Year 2023 is shaping up to be an interesting inflexion point for BRI investments in Southeast Asia. As China marks the 10th anniversary of its flagship BRI this year, its investments into top BRI destinations like ASEAN will be closely watched for signs of how it will recalibrate its New Silk Road strategy and redirect its investments in coming years.

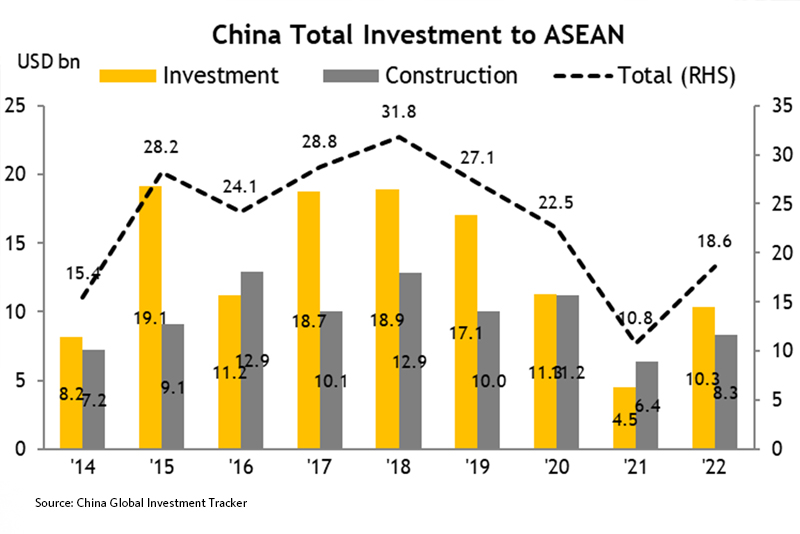

Investment and construction contracts from China to ASEAN last year rose to US$18.6 billion, up 72 per cent from US$10.8 billion in 2021, although this remained well below the pre-pandemic five-year average (2015-2019) of US$27.9 billion, Maybank Investment Banking Group economists wrote in a recent report on China’s Belt and Road ambitions.

These investment flows are likely to rise as China fully re-opens its economy and embarks on the next phase of BRI development, with an emphasis on risk control.

“Many ASEAN countries, which largely fit the bill for these principles, could well

become key beneficiaries of China’s shift towards more environmentally and

financially sustainable projects over the longer term,” said Dr Chua Hak Bin, Co-Head, Macro at Maybank Investment Banking Group (Maybank IBG).

ASEAN bucks the global trend

Prior to the pandemic, ASEAN had been a significant beneficiary of China’s outbound investments under the BRI. Investment and construction contracts from China averaged around US$27.9 billion from 2015 to 2019, before falling to just US$10.8 billion in 2021. In 2022, it rebounded 72 per cent to US$18.6 billion, mainly due to the stronger recovery in investment and construction deals.

ASEAN’s robust recovery in 2022 contrasts with the slump in total global BRI investment, which dropped to an average of US$65bn between 2020 and 2022, from an average of US$114 billion between 2017 and 2019.

Fig 1: China’s BRI Flows to ASEAN Rebounded in 2022, Mainly on the Back of a Rebound in Investments

“Within ASEAN, while Indonesia, Malaysia, Singapore, Thailand and Vietnam have seen stronger China investment inflows or applications, the Philippines has yet to see a significant rebound. For the region as a whole, a recovery in Chinese BRI inflows is unlikely to raise engagement to pre-pandemic levels,” said Dr Chua.

One reason is the waning appetite for China’s money. There is growing hesitancy to accept China’s investments as countries grow more wary of its growing power and regional influence, amid territorial disputes in the South China Sea.

A second reason is that China is curbing rapid overseas expansion as it focuses on domestic growth. In its 14th Five-Year Plan (FYP) for 2021 to 2025, the Chinese Ministry of Commerce set a lower target for outward direct investment of US$550 billion, which includes funding to non-BRI countries. This is 24 per cent lower than the US$720 billion earmarked during the 2016-2020 period.

Thirdly, China is not as quick to disburse BRI funds as it did during the pre-pandemic period because of the deteriorating debt servicing ability of recipient countries. Recent data showed that nearly 60 per cent of China’s overseas loans are held by countries considered to be in financial distress, compared to just 5 per cent in 2010. In Laos, for instance, loan commitments by Chinese lenders between 2000 and 2017 reached 65 per cent of GDP.

Building a quality BRI programme

Amid greater cautiousness amongst Chinese investors and recipients alike about future BRI engagement, quality over quantity is likely to be a key guideline and characteristic of new ASEAN projects.

Recent BRI trends indicate a shift in focus to new sectors such as renewable energy, technology and Electric Vehicles (EVs), while coal projects are likely to be phased out as part of China’s contribution to cutting climate-warming greenhouse gas emissions.

“A key new focus for Belt & Road projects is sustainability – particularly in renewable energy and electric vehicles,” noted Maybank IBG’s Head of Research Singapore & Regional Head of Financials Thilan Wickramasinghe. “Most ASEAN economies have made Net Zero commitments and the transition journey will require massive investment. We think China’s BRI could be a critical enabler here as the region pursues its low-carbon ambitions.”

This shift towards more sustainable initiatives is already reflected in the decline in China’s coal project investments in ASEAN, while its investment into renewable energy, which includes hydrogen, solar, wind, has picked up across the region.

Coal projects made up just 6 per cent of total energy investment and construction in ASEAN in 2022, compared to 44 per cent in 2020 and 31 per cent on average over the 2013-2019 period. Meanwhile, the share of China investments in hydropower and alternative – mainly wind and solar – energy has been increasing. Renewable energy investments dominated energy projects last year, with 83 per cent of China’s total investment flows directed to ASEAN’s energy sector.

Last year, China’s EV companies stepped up investments into ASEAN, with BYD set to start EV production in Thailand by 2024 and CATL setting up EV battery production in Indonesia. In Laos, PowerChina’s joint venture with Thailand’s Bangchak Corporation is building a US$1.5 billion wind farm which will sell electricity to state-run Vietnam Electricity via 500kV transmission lines when it is completed in 2025.

Technology projects will likely increase over time, driven by the rapid digitalisation of ASEAN economies. In particular, Chinese investors may participate in smart city development such as Thailand’s Eastern Economic Corridor and the Philippines’ New Clark City, to meet the region’s needs for digital infrastructure, which have accelerated since the pandemic.

On the digital front, China is equipping Thailand with smart city technology and enhancing its e-commerce capabilities.

Stronger ties and inflows

“Beyond the BRI, China has been pursuing other forms of cooperation as it looks to preserve and strengthen economic links with ASEAN. ASEAN is likely to grow in importance as a market for Chinese firms, as the government seeks to diversify export markets partly as a hedge against intensifying geopolitical tensions and Western countries’ push to “de-risk” from the Chinese economy,” said Dr Chua.

He added that in the short term, China’s outbound investment appetite may be affected by risks such as geopolitical tensions and its own domestic growth concerns amid an uneven economic recovery held back by soft business and consumer confidence.

Still, Chinese BRI engagement in Southeast Asia, which overtook the United States and the European Union to become China’s largest trading partner, is likely to gain momentum in the post-COVID era.

“Restarting pandemic-stalled Belt & Road projects could provide a boost to growth, especially as ASEAN economies themselves ramp up after COVID-19 lockdowns,” said Mr Wickramasinghe. “Increased investments in infrastructure can have positive spillover impacts across multiple sectors including banking, property, manufacturing, utilities, commodities and more. The second and third-degree flow through will support employment, SMEs as well as intra-regional connectivity,” he added.

the bottom line:

BRI engagement in ASEAN is recovering and will likely focus on financially and environmentally sustainable projects in the coming years.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram