It pays to think about retirement early, even if you're just at the starting line of your career.

Delay no more. Or in Hokkien, mai tu liao. An often-heard and quintessentially Singaporean mantra when shopping during mega retail events like Singles' Day. Or when it comes to school examinations. Push back your revision and you would be pulling a torturous all-nighter.

The same advice applies just as well in retirement planning. Do it as early as possible, and you could retire in comfort. Leave it till late and it will be painful, as it gets harder to set money aside when mortgages, family expenses and hospital bills creep in.

You may be in your 20s, but it certainly does not hurt to think about the day you lay down your work tools. Begin with the end in mind, and perhaps the end will be a bit sweeter and more enjoyable.

If retirement is a plane flight, a long runway helps

Retirement is no helicopter launch. Instead, it requires a long runway for a smooth flight into post-career paradise. This runway will be your long time horizon if you start planning for retirement in your 20s.

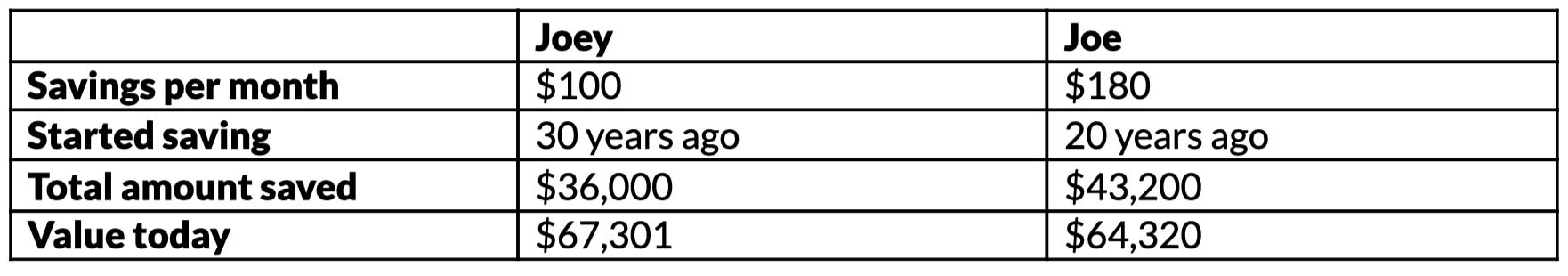

Such is the beauty of compound interest, where your sum of money grows exponentially. Time is your greatest asset - you could be putting in a lower total amount over a long period, and still amass more value than someone who put in more money over a shorter time.

See the examples of Joey, who started saving $100 a month 30 years ago, and Joe, who started saving $180 a month 20 years ago. Thanks to a longer runway, Joey emerges with more value, assuming a return of 4 per cent annually.

If you are a snow-loving holidaymaker who fancies Hokkaido as a retirement vacation, this outcome is also known as a snowballing effect. One way to capitalise on compounding your returns is through endowment plans.

Your money is shrinking with time

Riding on the snow-balling effect is all the more crucial in the face of inflation. Your $3 bubble tea will cost $6 in 24 years, if the inflation rate is 3 per cent - assuming your ageing body is still up for the sugary beverage!

But you get the point. The days of leaving cash in a savings account with minimal interest are long gone if you are serious about having a comfortable retirement life.

Many think that relying on your Central Provident Fund (CPF) savings is enough. After all, Singaporeans will be automatically enrolled in CPF LIFE, an annuity insurance scheme that provides you with monthly payouts from age 65. This could provide you with about $350 a month if you have $60,000 savings in your retirement account at age 65, or more than $1,500 a month if you have about $300,000.

Considering the eroding effect of inflation and the rising cost of living, it's really not much if you want a good standard of living after a lifetime's slog.

How to get started

First, you need to ask what kind of post-career lifestyle you would like. Estimate the monthly amount required, then account for inflation. It could be scary for a 25-year-old planning to retire at 65. A basic-looking $2,000 a month could become $6,500 in 40 years on 3 per cent inflation a year.

One easy way to determine the ideal sum you need for retirement is by using Maybank's retirement calculator, developed together with Etiqa Insurance.

If you're counting on your children to support you in your old age - nearly half the people in a recent survey expect this - you deprive your children of their own retirement funds.

With a longer time horizon in your 20s, you might be able to make riskier but more rewarding investments in stocks and equities, even as you balance them with safer endowment policies and bonds. Mai tu liao.

the bottom line:

Imagine the nightmare of outliving your savings. Start planning now for your post-work years.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram