A salary even after retiring? Really?

Sure, the best time to plan for retirement may be when you get your first paycheck. But let's be frank - many people don't actually do that. The next best time then, is now, even if you're in your 50s. Hear us out.

There are certain advantages to saving for retirement in your 50s: You are at your peak earning years, your kids might have even started working, and you might have paid off your mortgage.

Nonetheless, you still need to make a plan. This is especially so as you have a shorter runway for your money to compound. To figure out how much is needed for your desired retirement lifestyle, you may use retirement calculators like these.

Here are some other tips:

1. Make your money work

With a shorter runway to compound your nest egg, your investments need to count for more. The Rule of 72 is a simple way to determine how long an investment will take to double, given a fixed annual rate of interest. Just divide 72 by the annual rate of return and you can obtain an estimate of how many years the initial investment will take to double.

But for someone with a shorter time horizon, guarding your savings is important to have enough for your golden years. There are three ways to do this: Lower your risk profile and avoid products that might lose you your capital, buy those that can be easily liquidated for cash, and consider plans that generate a regular income (like a salary!).

For instance, consider the Maybank Global Retirement Solutions, featuring global multi-asset income products that aim to deliver regular payouts and capital appreciation with potentially lower downside risks. This is how you can earn a “salary” even after retiring.

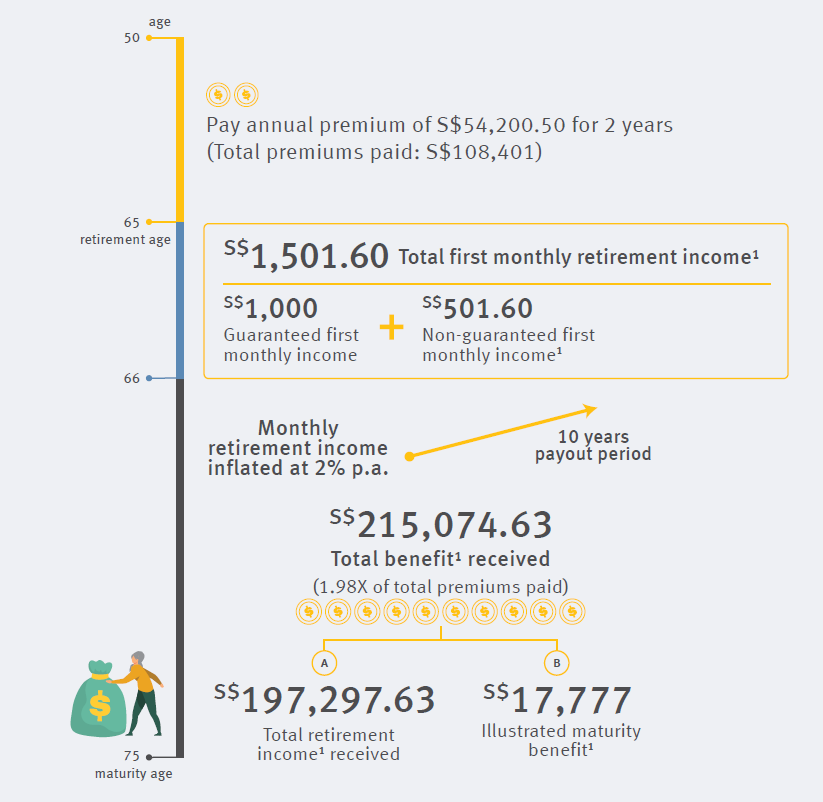

You could also take up an insurance endowment plan to fund your retirement income. An example is Enrich retirement: At age 50, you could select a two-year premium term and receive an inflated income payout period of 10 years from retirement age 65.

Based on an illustrated investment rate of 4.25 per cent per annum:

2. Downsize to maximise your property value

If your children have plans to move out to live independently or relocate overseas to work, it may be a good time to downsize your apartment to encash the capital appreciation of the home. Or, you could consider renting out a spare room for extra cash each month.

When you reach your mid-60s, you can consider the Housing and Development Board's (HDB) Lease Buyback Scheme which allows you to sell part of your flat's lease back to the government. The proceeds will be used to top up your CPF Retirement Account, from which you will get a steady income from CPF LIFE - a life annuity scheme that provides Singaporeans with a monthly payout.

3. Be CPF-savvy

Give your CPF LIFE payouts a boost by investing through the CPF Supplementary Retirement Scheme (SRS) - a voluntary scheme that allows individuals to save for retirement in addition to their CPF savings. There's a wide range of products you can invest in with SRS monies - bonds, unit trusts, equities, exchange-traded funds (ETFs) and so on. Investment gains are also tax-free.

Here's an SRS tip: The year you make your first contribution to your SRS account affects the year in which you can withdraw your SRS funds. For example, if you make even a $1 contribution this year while the statutory retirement age is 62, you can withdraw it at 62 years old - even when the retirement age is raised to 63 in 2022.

Recent developments have also helped bolster retirement plans for those in their 50s. For instance, from 2022, CPF contribution rates for senior workers will increase by either 0.5 or 1 percentage point for workers aged 55 to 70, depending on the person's age.

4. Delay retirement

Or how about delaying retirement? The statutory retirement age in Singapore will be revised to 63 while the re-employment age is raised to 68 from July 2022. Working longer does not sound as bad as it does.

It lowers the number of years your portfolio needs to last, allows for some compounding work - and it may even improve your mental health and social life.

If you are keen to retire in your 50s, consider part-time or short-term employment, where you can contribute your experience or skills, to supplement your retirement income.

the bottom line:

Even if you can't depend as much on compounding in your 50s, simple ways to save and the smart use of investments and CPF can go a long way.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram