Unlock funds from your property and have the freedom to use it in more ways than one.

It is common financial wisdom that saving for your retirement should always start as early as possible.

But the reality is life doesn't always go as you want it to - not everyone is a planner or has the luxury to do that. And sometimes, even with all the planning, unexpected challenges can still come up.

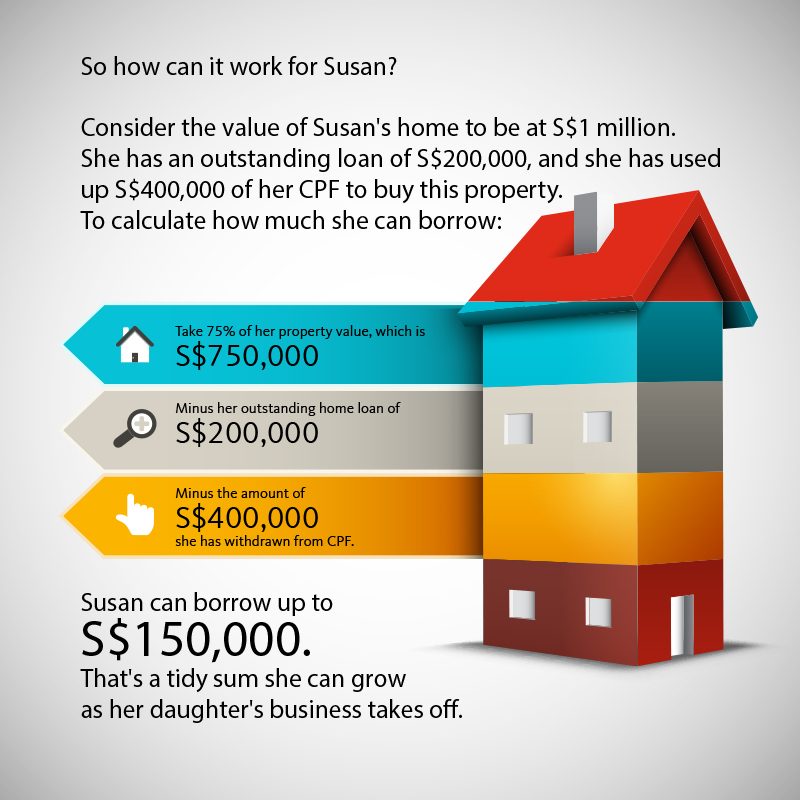

Take the example of retired schoolteacher, Susan, who lives in a single-storey terrace house. Lately, the 62-year-old has been thinking about converting an empty room into an office for her daughter's new interior design business, which she also wants to invest in.

There is just one problem: Susan does not have a regular retirement income she can use to power these plans.

Selling her home for some cash is out of the question, as she intends to continue living in it. Nor does she want to share her space with a tenant.

Here is where an equity term loan can help Susan to unlock value from her property, converting her equity into the cash she needs.

What is an equity term loan?

An equity term loan is where you borrow a fixed amount of money that is secured against your home. Put another way, it is when you “cash out” an existing property. In Singapore, only private property owners are eligible for equity term loans for homes.

The loan amount takes into consideration the loan-to-value ratio, the property's current market value, the homeowner's outstanding mortgage sum (if any) and the amount of their CPF utilised on the property (if any).

Maybank's equity term loan allows homeowners to borrow up to 75 per cent of the property's value, which can be used for a range of purposes, such as funding your children's education, sprucing up your home or starting a business.

The repayment period can be up to 35 years (or up to age 75 at loan maturity, whichever is earlier) for private properties. The total debt servicing ratio rule applies, which means your total monthly loan commitments cannot be more than 60 per cent of your monthly income. You can get an exemption on the total debt servicing ratio if the loan-to-value limit does not exceed 50 per cent.

Equity term loans typically come with low interest rates - Maybank is currently offering it from 1.3 per cent per annum - that are much more attractive than other loan types.

Be smart with your cash

Equity term loans can be useful for people like Susan and those who have to deal with unforeseen financial situations, from medical emergencies to investment opportunities.

It is especially appealing for those whose homes have increased in value over the years, and can be a smart use of leverage amid the prevailing low interest rate environment.

What's important to know is that equity term loans are secured against your home which means you could risk losing the roof over your head, so keeping up with the payments is crucial. It is not advisable to opt for this facility for frivolous reasons such as large purchases or gambling.

Channelling the funds towards investment instruments or insurance, on the other hand, can help you achieve the retirement lifestyle you want by combining regular payouts and capital growth. Maybank Global Retirement Solutions allow customers to invest in several funds that capitalise on market opportunities for potentially higher gains or in global growth stocks and bonds for long-term capital appreciation, with the potential of providing regular payouts of up to 6.88 per cent a year.

This way, you're not only accessing funds to pay for unexpected expenses or everyday retirement living costs, but also growing your wealth for your golden years.

the bottom line:

An equity term loan can be a good way to unlock your home's value to meet your retirement needs as you consider all angles to find the best solution.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram