Witness some financial magic with the power of compounding and make your money work for you without lifting a finger.

"Compound interest is the eighth wonder of the world."

Even the late Albert Einstein, who revolutionised the world of science, acknowledged the financial "superpower" that is compounding when he was said to have made that statement decades ago.

Compound interest refers to additional interest received on both the original sum of money invested and the interest that has accumulated over time. In short, your money makes money - without you doing a thing about it.

It is not only enticing, but crucial too. In October 2021, Singapore's overall inflation rose 3.2 per cent, hitting the highest it has been in eight years, with the prices of food, amenities and services going up. In the battle against rising costs, compounding is becoming more important than ever.

As Einstein also said, "He who understands it, earns it. He who doesn't, pays it." Here's how compounding can help turbo-charge your finances.

The power of compounding

First, it is key to understand the difference between simple interest and compound interest.

• Simple interest is calculated based on the principal sum of money at a given rate over a period of time.

• Compound interest, on the other hand, is the sum accrued from both the principal and the accumulated interest.

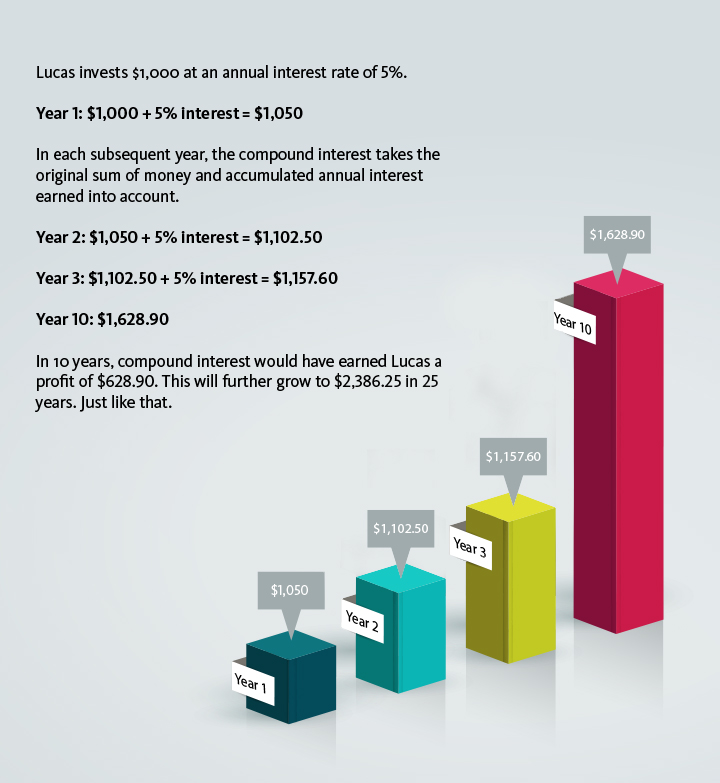

Here's a simple illustration:

In addition, the Rule of 72 is a quick and easy method to calculate how long it will take for your initial investment to double.

The formula is simple: Divide 72 by the interest rate. For example, if you were to stash away $10,000 in an investment account with an annual interest rate of 3 per cent, it would take about 24 years before that figure doubles to $20,000.

Slow and steady wins the race

Maximising the benefits of compound interest requires plenty of time and patience. The key is to start early.

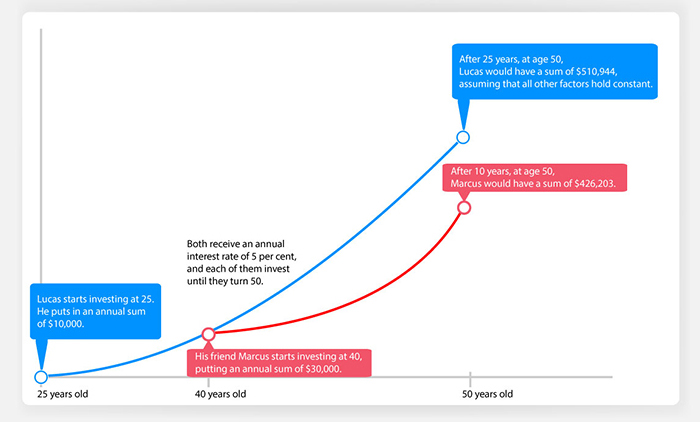

In fact, starting earlier with less money results in higher earnings, rather than starting later with more money. Let's look at how Lucas, an early-starter, fares against his friend Marcus, who begins investing at a much later age:

Even though he invested more than Lucas each year, Marcus still earned nearly $100,000 lesser - simply because he started later. When it comes to compound investing, getting an early start beats investing more money at one time. Slow and steady wins the race.

And rather than putting all your money into a savings account where interest rates are close to zero, there are better ways to grow it. For instance, by investing it in a balanced fund.

Combining the deep expertise of its fund managers with systematic investing technology, Maybank Asset Management Singapore's new Asian Growth and Income - Islamic Fund offers investors a diverse mix of securities. These range from Shariah-compliant Asian stocks to gold ETFs, catering especially to investors looking for purpose when it comes to investing.

No time to lose

Warren Buffet, one of the most successful investors of all time, made compounding a key cornerstone of his investment strategy, earning billions in the process.

This should be a core pillar of your financial approach too. Start early, invest strategically, and you may be reaping bountiful rewards down the road. Understand how it works, give it some time, and reap the rewards of patience down the road.

the bottom line:

Superpowers do exist in the world of finance. Make your money work for you with compounding.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram