Islamic Wealth Management is a sector gaining popularity and should be considered by Muslim and non-Muslim investors.

Supported by strong demand, the market for Shariah-compliant investing has been growing steadily in recent years, with private banks and investors starting to show interest. But the global Islamic Wealth Management (IWM) industry remains largely untapped and is poised for growth in the near future.

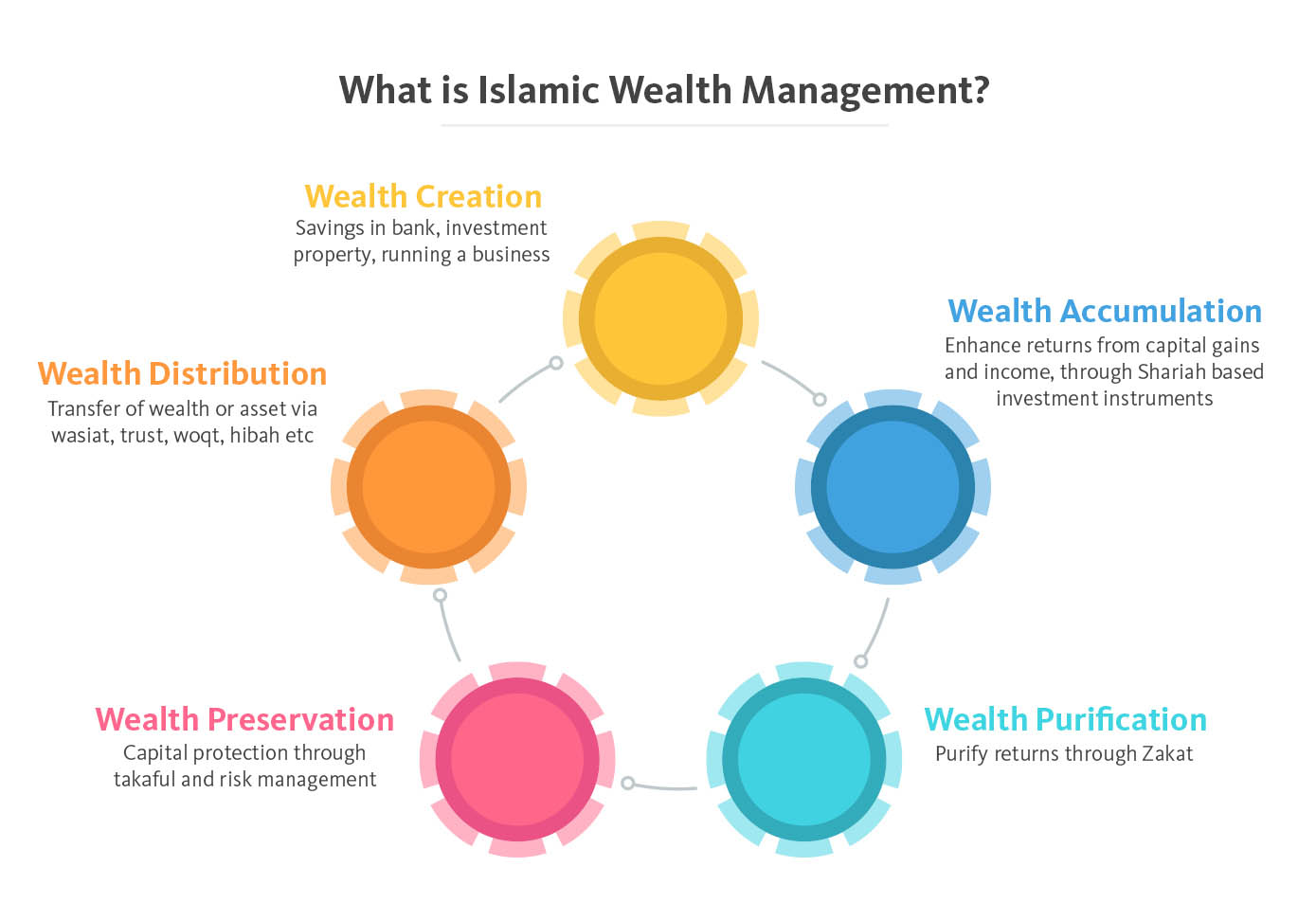

What is Islamic Wealth Management?

IWM is a discipline that aims to provide comprehensive solutions to clients via Shariah-compliant products and services in a wealth management cycle. Shariah defines five necessities as the fundamentals of human existence, namely faith, self, posterity, intellect and wealth, thus it is the responsibility of every society to preserve and protect these fundamentals. These Shariah fundamentals serve as the foundation for the development of Islamic financial products.

Let's take a look at the wealth management cycle from a Shariah perspective:

- Wealth Creation: The creation of wealth through income derived from Halal/Shariah-compliant businesses, professions or trade and savings with Islamic financial institutions.

- Wealth Accumulation: The enhancement of wealth by generating returns via Islamic investments and instruments, such as Islamic equities, sukuk (Islamic bonds) as well as Islamic funds.

- Wealth Purification: The purification of wealth through the concept of zakat. Zakat is the giving of alms to the poor and needy and is obligatory upon every Muslim who meets the requirements to pay zakat.

- Wealth Protection: The protection of wealth through risk management, takaful (Islamic insurance) and Islamic trusts.

- Wealth Distribution: The distribution of wealth for future generations. This involves the transfer of wealth or assets (estate planning) through wasiat (will writing), waqf (endowment) and hibah (gift).

How can one access Islamic Wealth Management?

Although the popular belief is that Islamic finance is only for Muslims, that is not the case. Everyone irrespective of their religious faiths can take up Shariah-compliant financial products and services, which include Islamic deposits, investment, treasury and financing, and other value-added products and services at a retail bank or an Islamic financial institution.

In addition, Maybank Islamic has launched its Islamic private wealth solutions for its private wealth clients since March 2017, enabling high net worth individuals to optimise their various investment portfolios which are managed based on Shariah principles in a holistic manner.

Another viable option includes Islamic estate planning. Estate planning provides an allocation and arrangement to pay the deceased's debts and obligations by appointing an executor or trustee to manage the deceased's assets. Through will writing, an individual would ensure the assets or properties are distributed to their loved ones for posterity.

Going one step further, there is an increased demand for sophisticated Islamic wealth management products, for example, the introduction of structured wealth management products to complement existing plain vanilla Islamic wealth management offerings. All these developments bode well for retail clients and the Singapore financial market, offering more choices to grow and protect one's wealth.

the bottom line:

Diversify your portfolio by considering Shariah-compliant investment products.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram