Non-fungible tokens, or NFTs, seem to be popping up everywhere these days. Before you take the plunge, familiarise yourself with the concept.

29-year-old Hafiiz Karim, who goes by the moniker The Next Most Famous Artist, is known for placing classical art characters within familiar Singaporean settings in his unique brand of art.

His career took a big turn when he turned to non-fungible tokens (NFTs) to sell his art instead. Where Hafiiz used to earn an average of S$1,000 each month from selling physical prints of his digital work, in just one year, he has sold more than 200 NFTs worth about US$150,000.

NFTs are becoming a lucrative source of income for some, not only in Singapore

but also across the world. And for some investors, it can even translate into thousands

of dollars in overnight profits. But what exactly are they?

Non-fungible what?

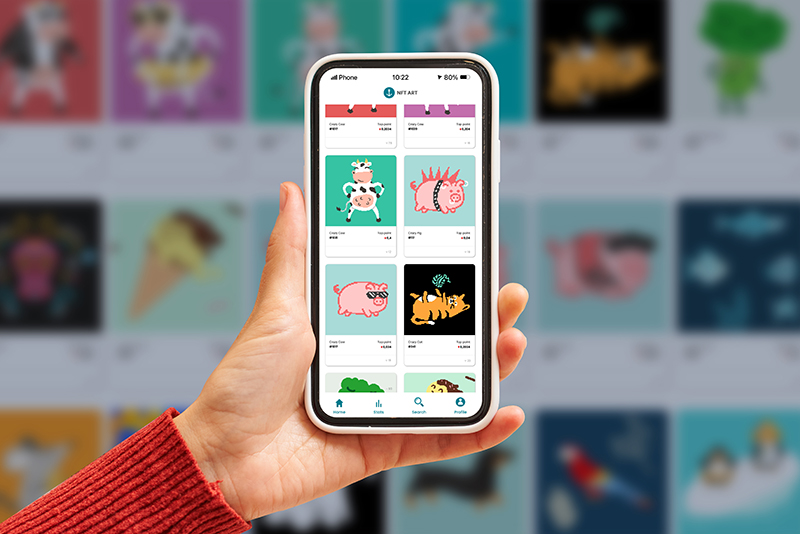

NFTs are unique digital tokens that digitally represent ownership of real-life items, anything from an art piece to music, collectibles, real estate, or even tweets. Twitter Chief Executive Officer Jack Dorsey actually sold his first tweet as an NFT for over US$2.9 million last year.

NFTs are traded using cryptocurrencies such as ethereum and Solana, and are not interchangeable.

What makes no two NFTs alike is the unique digital signature assigned to each token that is secured and verified by blockchain technology. While someone may have a digital copy of an artwork, they would not have the “original” copy recorded on the blockchain.

So when you buy an NFT, you receive a token or an exclusive proof of ownership on the blockchain that makes it easy to verify, which is important when it comes to selling or transferring tokens to another owner.

Yay or nay?

As the newest and coolest kid on the cryptocurrency block, NFTs have skyrocketed in popularity during the pandemic as it entered the mainstream consciousness of investors.

What makes buying an NFT attractive?

• Accessibility. Anyone can invest in NFTs, as long as you have some cryptocurrency to do that with. With NFTs, any physical asset, from real estate to artwork to jewellery - many of which are known to appreciate in value over time - can be fractionalised and owned by a group of people. The world is your oyster.

• Easy to verify. Your NFT proof of ownership is built on blockchain technology, which holds a record of authenticity that is easily traceable and verifiable.

• Expanding your portfolio. It could offer added diversification benefits to your investment portfolio, especially in a post-pandemic and increasingly digital world.

But there are also several risks to watch for:

• Volatile and illiquid. The price of your underlying asset is determined by the “hype” around it, or according to seller-buyer agreements. This means it can be difficult to ascertain the actual value of the asset in the long run, or find buyers in the marketplace even when you can. Additionally, when prices are inflated, investors are at the mercy of speculation, and risk outsized losses should the hype die down.

• Energy-intensive. When French artist Joanie Lemercier first sold his artworks in the form of six NFTs, the sale consumed 8.7 megawatt-hours of energy - a figure equivalent to two years of energy use in his studio. Similar to the validation of cryptocurrency transactions, NFT minting and transactions consume massive amounts of energy. Not exactly the best fit for the climate crisis our world is facing.

• Lack of regulation. NFTs and cryptocurrency wallets are susceptible to hacking, crimes and fraud. Additionally, there is no guarantee that a seller will deliver. The Monetary Authority of Singapore’s stance on NFTs is that as with all investments in digital tokens, NFTs are not suitable for retail investors. Investors should practise extreme caution when investing in them.

Tread lightly

To be clear, an NFT on its own is not an asset class or investment. It is a digital representation of the underlying asset you’re buying, therefore make sure you understand the value of that asset before you purchase the NFT.

For all the excitement they’ve created so far, NFTs remain a wild and unpredictable endeavour.

the bottom line:

NFTs appear to have become a new way for investors to cash in, but as with any nascent technology or trend, tread lightly.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram