Many of us plan to retire with a stable, passive income. Investing in dividend stocks is one of the popular ways to achieve this.

Imagine receiving your dividend pay check every year, regardless of whether the markets go up or down.

The quick way to identify dividend stocks is by searching for stocks with stable income, low debt and good dividend yield.

1. Stable income

The main goal of going into business is to make money. One of the first criteria we must have when choosing a company is to see if the business is able to generate good and stable earnings. To do this, we use the Return on Equity (ROE) financial ratio. It measures how efficiently the management of the company is using its resources (shareholders' equity) to generate profits.

2. Low debt

One of the most common downfalls of any business is the inability to repay its outstanding

loans. Hence, it is important to ensure that the companies we invest in do not go bankrupt

before we exit. We can use the financial ratio called Debt to Equity ratio (D/E) to measure

the debt level of the company relative to the shareholders' equity.

A certain amount of debt is necessary to ensure that businesses thrive. But how much is too

much? Ideally, the D/E should be less than 1 (the amount of debt is less than the amount of

shareholders' equity). Otherwise, there could be a risk that the company will not be able to

repay its debts.

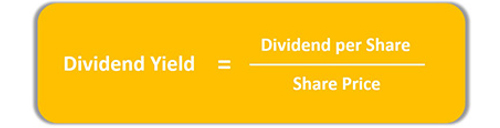

3. Dividend yield

When a company is able to generate stable income with low Debt to Equity ratio, we would like to be rewarded as a shareholder. Companies with a stable income usually reward their shareholders by returning the profits in the form of dividends. We can use the financial ratio called Dividend Yield, which compares the dividends against the share price. The higher the Dividend Yield, the higher is one's overall return from owning shares of the company.

Leveraging technology to enhance search process

The most frustrating thing in investing is the fact that there are so many dividend stocks to pick from. Is there a better and simpler way to find good dividend stocks? A quick check on Singapore Stock Exchange website shows that there are close to 700 listed companies. Fortunately, with the help of technology, the search process can be automated with the use of screeners.

To summarise, looking for investment ideas can be simplified if we keep in mind the basic criteria that define a good and well-managed company. One that is generating stable income, has low debt and rewards shareholders with consistent dividend payouts. Finally, leverage screening tool to simplify and automate the search process. Whether you are a beginner, intermediate or advanced investor, you can learn more about investing with Maybank Kim Eng.

the bottom line:

Start making your money work harder for you.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram