Singapore's REIT market has burgeoned since its inception in 2002. It is a good means to access real estate investing.

Have you thought of investing in a piece of premium real estate like a hotel or office building and collecting rent year after year?

In Singapore, investing in a physical property cost entails a heavy capital outlay or down payment. Most of the retail investors find it hard to scale their portfolio of properties. With Real Estate Investment Trusts (REITs), investors can now diversify their portfolio with lower capital outlay.

What are REITs?

A REIT is a trust that owns and in most cases manages income-generating real estate assets. Investing in a REIT gives you exposure to not just one, but a portfolio of properties - some of these may even include international properties. The main source of income of a REIT is rent from tenants.

In Singapore, the first REIT was launched in 2002 on the Singapore Exchange, and it has since expanded to a total of 42 S-REITs and property trusts with a total market capitalisation of around S$100 billion. This accounts for around 12% of the Singapore Exchange's market capitalisation.

According to a SGX research report in May, S-REITs averaged 7% gains year-to-date in 2021, bringing their 12-month average gain to 18%. This is in line with the median total return of all APAC-listed REITS at 17%. As of the end of April 2021, S-REITs averaged a 5.6% dividend yield.

One reason why S-REITs pay considerably higher dividends is because they are required to distribute at least 90% of taxable income each year to enjoy tax exempt status by IRAS (subject to certain conditions), making them a popular instrument for passive income seekers.

As compared to direct property investing, REITs are extremely liquid. In general, a property transaction in Singapore could take up to four months to complete. On the other hand, an investor is able to trade REITs like equities, and access pricing information in a transparent manner on any trading day.

What are the different kinds of S-REITs available?

REITs offer a relatively lower risk with a diversified portfolio of properties. Investing in a REIT allows investors to own shares of multiple properties at the same time. As compared to owning a property where your risk is entirely concentrated in one asset, investing in a REIT enables you to spread your risk across multiple properties.

REITs listed in Singapore (S-REITs) may comprise properties located overseas, such as Australia, China or Europe, giving investors exposure to properties situated in mature or growth markets.

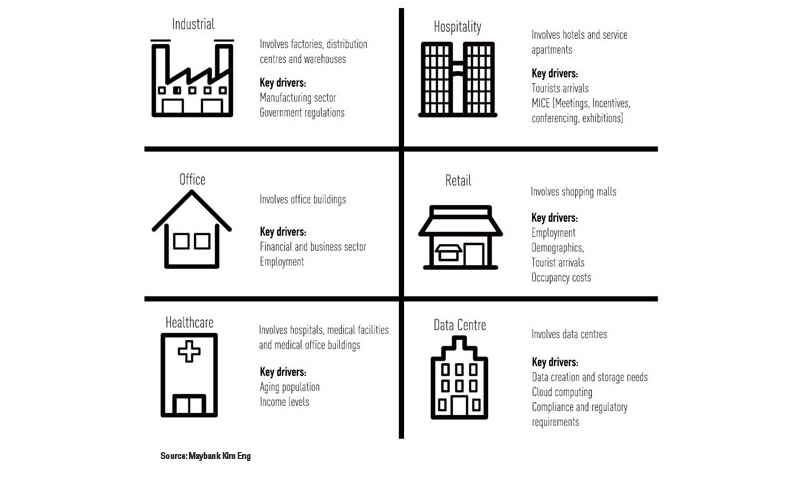

Other than geographical locations, consider the real estate segment that the REIT specialises in, for example, there are industrial REITs, retail REITs, office REITs and hospitality REITs. The business sentiment and market demand of various real estate types affect the revenue prospects of each REIT.

How do I decide?

With so many types of REITs out there, it's hard to decide on a particular one to invest in. You can consider these two parameters when looking for undervalued REITs that offer good dividends.

• Price-to-book ratio (PB): Calculated by dividing the REIT's price per share by its

book value per share.

• Dividend yield: Calculated by dividing the amount of dividend a REIT pays out each

year over its share price.

A REIT's asset quality is also important. Its portfolio of assets should bring in stable rentals with a healthy occupancy and reasonably long lease contracts.

It is noteworthy that some REITs may carry more risk than others, since they are subject to political and regulatory risks. Do read up on the IPO prospectus of each REIT and financial information disclosed to investors to understand the background of its sponsor, investment mandate, management framework, dividend policy and asset quality.

Buying a REIT carries risk, which means you should evaluate your risk appetite and holding period.

Reach out to your Maybank Kim Eng trading representative to invest in REITs today. Log into your MKE trade or KE Trade to view the latest market insights.

the bottom line:

REITS give you access to property investments at a fraction of the cost.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram