Earning without working is everyone’s dream, but how can we make it a reality? Make your dreams come true with passive income investing.

We are always on the lookout for greater financial stability, security and freedom – and building additional income streams through investing is one way to do this.

Though not as explosive as Bitcoin or growth stocks, this tried and tested way, if done well, can bring regular returns with little effort.

Building passive income streams also serves as a bolster against rising inflation and helps to cover you through economic threats and storms.

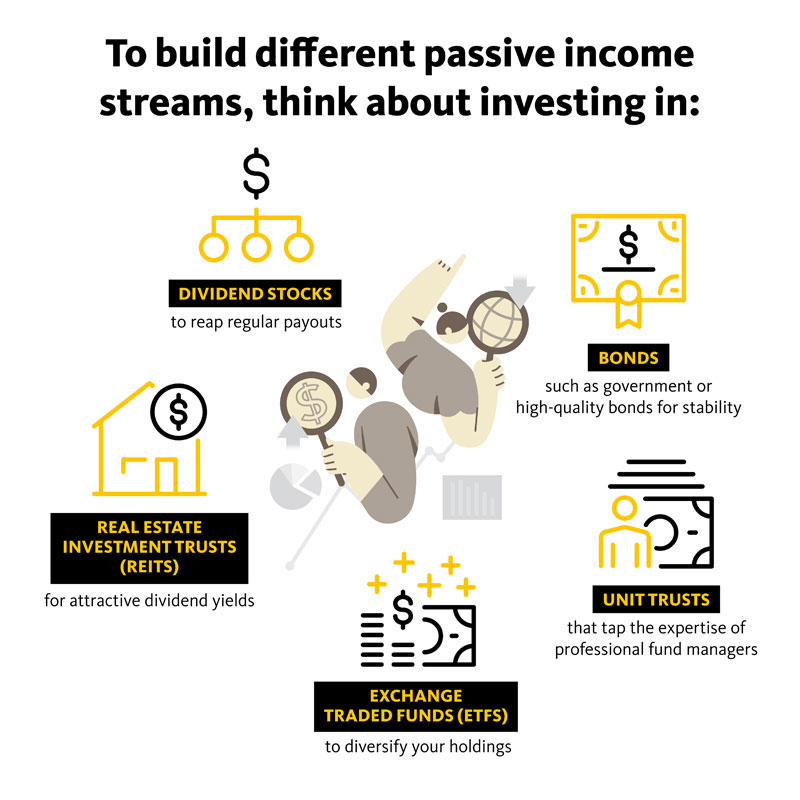

Here are five smart investing ideas for you to begin your passive income journey:

1. Dividend stocks

Investing in dividend stocks involves becoming a shareholder of a company which gives out regular payouts to its shareholders. And it is these dividends that form a significant portion of your total investment return. For example, if company A pays out a dividend of 3 per cent in a year and has seen its stock rise by 7 per cent, the total annual return works out to be 10 per cent.

These dividend earnings can be used to buy even more dividend stocks, allowing you to compound your returns.

That said, even the most rock-solid dividend-paying stocks are subject to market volatility. Be sure to invest a good amount of research and do your due diligence first to ensure that you do not end up on the losing end of circumstances you cannot control.

2. Real Estate Investment Trusts (REITs)

Singaporeans love their property. Real Estate Investment Trusts (REITs) offer the option of investing into real estate without having to fork out the massive capital outlay to buy or own the physical asset. It also frees you from the hassle of looking for tenants and maintaining the property.

REITs are easily accessible and popular since they are traded on the stock exchange. Additionally, REITs listed in Singapore are mandated to pay 90 per cent of their income to investors annually to avoid corporate tax. This gives a great deal of assurance that the money will come rolling in.

Similar to other dividend stocks, REITS are also subject to risks. For example, retail REITs took a beating during the COVID-19 pandemic when shopping malls were shut all over the world. Rising interest rates could also lead to higher interest expenses, particularly for REITs that have not effectively hedged their exposure.

3. Exchange Traded Funds (ETFs)

Exchange Traded Funds (ETFs) are a great way for investors to gain exposure to a variety of asset classes. Be it equity, fixed income or commodities, investors can use ETFs to build a diversified portfolio to mitigate uncertainty and risks.

In some ways, this is helpful for smaller investors looking to dip their toes in multiple asset classes or sectors, which otherwise might be impractical due to the minimum investment requirement and/or transaction fees required to invest in each individual security.

ETFs have also proven to be relatively stable during recessions due to its diversified nature – particularly useful given the uncertain market conditions looming overhead. Another plus point is that most are traded in both the Singapore dollar and the US dollar, allowing you the freedom to decide on your preferred currency exposure.

4. Unit trusts

By pooling your money with that of other investors, unit trusts allow you to buy into tradeable financial assets such as stocks, REITs and ETFs. They are actively managed by fund managers with various objectives, such as beating benchmark returns or offering stable income payouts.

For the newbie investor, unit trusts let you sit back and leave the work to the experts.

Like many other investment assets, they are subject to market volatility. Additionally, fund managers may charge higher fees for their services when compared to a passively managed ETF. If you choose to put your money in a unit trust, make sure that its fees do not eat into your returns.

5. Bonds

Bonds are an alluring option as most guarantee regular payouts and principal recovery.

An easily accessible government bond is the Singapore Savings Bonds (SSBs), which are issued monthly by the Singapore government. They are popular among many investors as they are fully backed by the Singapore government and offer an interest rate that increases over time.

In addition, with a minimum investment requirement of only S$500, investors are also able to withdraw their investments at any time with no penalties. In exchange for this element of safety and flexibility, however, SSBs offer comparatively lower returns.

Other bond investments such as corporate bonds and bond ETFs, on the other hand, tend to offer higher coupon yields. Most are traded on Over-The-Counter (OTC) markets, while some, such as retail bonds, can be found on the exchange.

Compared to SSBs, these bonds are a little riskier since the payment of coupons and principal is dependent on the bond issuer’s ability to repay. The prices can also be more volatile and susceptible to market crashes.

Build your wealth

With diligent planning, there are ways to make your money work for you while you sleep.

Investing S$1,000 regularly every month at an expected annual yield of 5 per cent could see your money grow a hundredfold to reach S$100,000 in just seven years.

Depending on your risk appetite, passive income investing can let you have your cake and eat it too. But, remember to have a balanced diet – diversifying your investments ensures multiple income streams that can help to mitigate the myriad of risks.

the bottom line:

Investing the smart way can build multiple streams of passive income, but make sure you diversify and fully understand the underlying risks.

Linkedin

Linkedin Facebook

Facebook Email

Email Whatsapp

Whatsapp Telegram

Telegram