8% CASHBACK FOR MALAYSIAN RINGGIT SPEND

Credit Card

The card with freedom of choice, just #ForYou

Pick and choose cashback categories that best fit your lifestyle and enjoy 8% cashback – one of the highest in town!

Annual Fees:

Principal: S$180 (First 3 Years Free)

Supplementary: Free

Minimum Requirement:

S$30,000

With effect from 1 June 2023, earn 8% cashback on all your Malaysian Ringgit spend on top of your 5 preferred categories! This benefit is automatically included.

Make Family & Friends Card your travel companion to Malaysia now

Receive a Samsonite ENOW SPINNER 69/25 (worth S$570), or an AirPods (3rd generation) with Lightning Charging Case, or S$200 cashback when you apply for a new Maybank Credit Card or CreditAble and charge a minimum of S$1,300 within the first two months of card approval.

Terms and Conditions apply.

Your newly approved Credit Card account(s) will come with Online Banking and eStatements+. To view your eStatement, please sign-up via Maybank Online Banking (maybank2u.com.sg) and perform a first time login.

+Auto enrolment for eStatement is not applicable for Maybank CreditAble.

Enjoy the freedom to choose the cashback categories that best fit your lifestyle! Be it entertainment and online shopping for First Jobbers, groceries and petrol for Families or wellness for Silver Generation, you can be sure to find the cashback categories that are perfect for you!

Earn 8% cashback globally on your 5 preferred cashback categories from the list of 10 options.

Stock up your daily necessities from grocery stores, supermarkets or shop your groceries online.

Feast in delight with your family and friends or order food to have them delivered at your convenience.

Fuel up or service your car, hail for a ride or simply tap and go for bus and train trips.

Enjoy Exclusive Fuel Savings of up to 26.45% at Caltex with Diamond Sky (DS) Fuel Card – one of the highest in town!

Always stay connected with your mobile and home internet plans, stream your favourite shows online or enjoy an array of entertainment with your TV cable subscription.

Shop for your kids and treats your pets to promote their well-being.

Indulge in online retail therapy anytime and anywhere.

Catch the latest movie or treat yourself to a live concert or play.

Get your daily essentials and supplements.

Feel good and stay in shape while doing your favorite sports.

Pamper & rejuvenate yourself with a well-deserved massage, facial or even hair treatment.

|

Minimum |

Cashback on |

Cashback on Malaysian Ringgit |

|---|---|---|

|

S$800 |

8% |

8% |

|

S$0 - S$799 |

0.3% |

0.3% |

Enjoy 0.3% cashback on your AXS bill payments when you pay with Maybank Family & Friends Card!

ONLY APPLICABLE FOR NEW CARD APPLICANTS

Be empowered with the choice of card design that best represents you! Select your preferred card design from the following 3 designs!

Choose your cashback categories seamlessly via Maybank TREATS SG mobile app.

STEP 1: DOWNLOAD AND LOG IN

Download Maybank TREATS SG app, and login with your Maybank Online Banking username and password.

2 ways to download the Maybank TREATS SG app:

Go to App Store or Google Play and search for TREATS SG

Scan the QR code

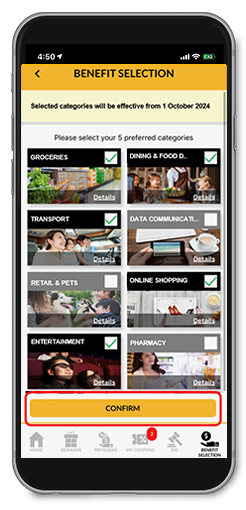

STEP 2: SELECT YOUR CASHBACK CATEGORIES VIA BENEFIT SELECTION

Access via the “BENEFIT SELECTION” icon on the right hand bottom menu bar to select your cashback categories.

STEP 3: CHOOSE YOUR 5 PREFERRED CATEGORIES

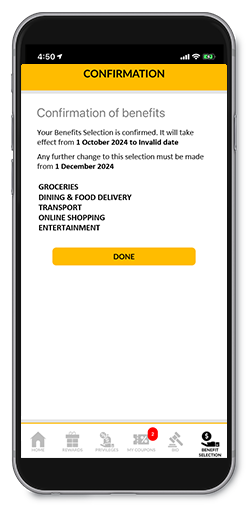

Select 5 of your preferred cashback categories and click on “CONFIRM” button. Once your selection is confirmed, selected cashback categories will take effect the next following month.

Note: Preferred cashback categories apply for 3 months after confirmation. You may change your preferred categories quarterly.

Refer to Family & Friends Card Cashback Programme Terms and Conditions for more information.

STEP 4: SPEND TO ENJOY 8% CASHBACK

Start spending on your 5 preferred categories to get 8% cashback, up to S$125 per month. One of the highest in town!

HERE’S A VIDEO GUIDE ON HOW TO MAKE YOUR CASHBACK CATEGORIES SELECTION:

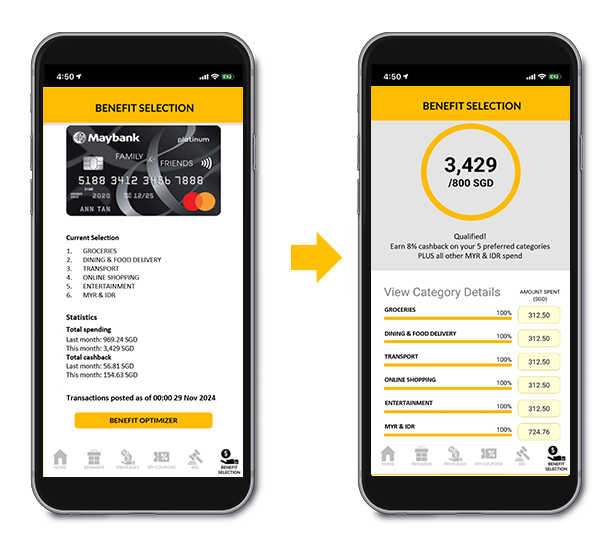

You can now track your spending and cashback via Benefit Optimizer in TREATS SG

You can now access ‘BENEFIT OPTIMIZER’ page via ‘BENEFIT SELECTION’ icon to monitor your spending and cashback earned every month.

Note: ‘BENEFIT OPTIMIZER’ page can only be accessed after the selection of cashback categories via ‘BENEFIT SELECTION’ is completed.

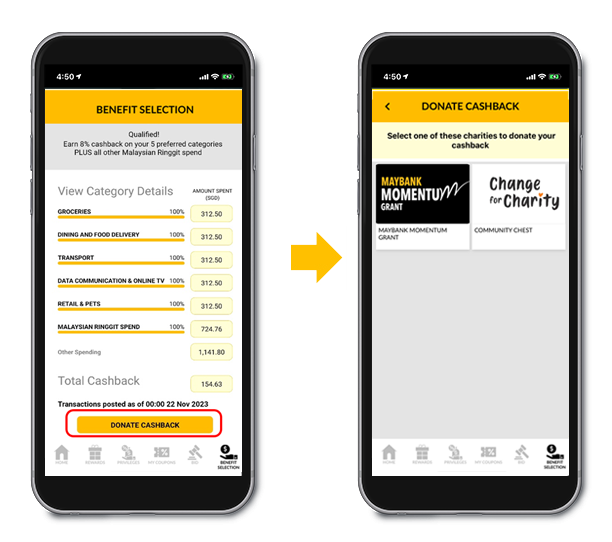

You can now choose to donate your cashback earned via Benefit Optimizer in TREATS SG app

Be empowered with the freedom of choice to donate your monthly cashback earned. Simply access the “BENEFIT OPTIMIZER’ page to perform a cashback donation to your choice of charity.

Supported Charities include:

Donate to the Maybank Momentum Grant to help small charities grow and better serve communities-in-need.

The Maybank Momentum grant provides promising charities with an interest-free recyclable grant, capacity building and SME banking solutions. Since launch, the Grant has supported 13 non-profits serving over 13,000 beneficiaries. For more info, please visit www.majurity.sg/momentum.

Your donation will be matched dollar-for-dollar by Maybank Singapore.

Donate to Community Chest to help the less fortunate.

100% of your donation will go towards over 100 social service agencies supported by Community Chest. For more information, visit www.comchest.gov.sg.

Every $1 dollar donated will be matched with $1 dollar from Maybank and $1 dollar from the Government, through the Change for Charity initiative.

Accepted almost everywhere in Singapore, Apple Pay is a safe, contactless, easy way to pay. Add your Maybank card today and use it at your favourite shops, restaurants, and more.

Mobile payment with Samsung Pay works at almost any retailer in Singapore, making shopping or dining easier and more convenient than ever before.

Principal Card: S$180 (First 3 years free)

Supplementary Card: Free

Age: 21 and above

Annual Income

¹ You can print your latest 12 months CPF Contribution History Statement using your Singpass via https://www.cpf.gov.sg/members. If your monthly income exceeds S$6,300 (Effective 1st January 2024: S$6,800), submit your latest Income Tax Notice of Assessment or computerised payslip instead, for proper maximum credit limit calculations.

² Print your Income Tax Notice of Assessment at myTax Portal using your Singpass or IRAS PIN.

Please allow 7 business days for processing, and application is subject to approval. Note that incomplete forms or missing documents will delay processing. The Bank reserves the right to request for more documents. Should the income documents you submit reflect a lower earned income than what was previously declared, the bank reserves the right to adjust the current credit limit to reflect the prevailing earned income.