| |

|

|

Maybank Quarterly - March 2020 |

|

| Maybank records higher FY19 PBT of RM11b on strong Q4 earnings |

|

|

| |

Maybank, Southeast Asia's fourth largest bank by assets, announced on 27 February 2020 that it achieved a record profit before tax (PBT) of RM11 billion for the financial year ended 31 December 2019, up from the RM10.9 billion a year earlier.

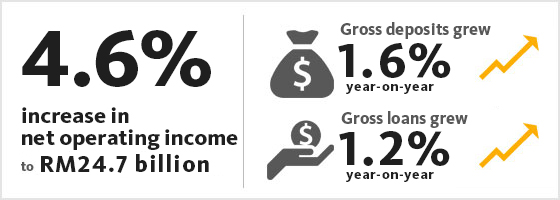

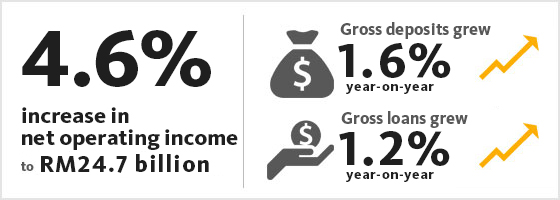

The results were boosted by robust performances of its Community Financial Services, Islamic banking and insurance & takaful segments, as well as a particularly strong fourth-quarter (4QFY19) which saw the Group record its highest ever PBT of RM3.26 billion, a 5.4% increase from a year earlier. This came on the back of a 4.6% improvement in net operating income to RM24.7 billion.

Net profit for the year also reached a new high of RM8.2 billion, from RM8.11 billion in 2018, lifted by 4QFY19 net earnings which were up 5.3% to RM2.45 billion from a year earlier.

More information on our results can be seen here. |

| |

|

| |

| Newsflash |

|

| |

| Stay alert and protect yourself from scams |

|

|

| |

There have been reports of fraudsters targeting Maybank customers and purporting to be representing Maybank through phishing calls. We wish to alert the public and customers that they should never divulge their personal information to unsolicited callers. Maybank will not request for customers' PIN, password or OTP through phone call, email or SMS. Do not proceed with the call if you suspect that the caller is asking you to conduct suspicious transactions.

How to protect yourself from scams:

Stay alert. Never provide personal or confidential banking account information to unsolicited callers. Stay alert. Never provide personal or confidential banking account information to unsolicited callers.

Alert Maybank if you receive an email, letter or a telephone call requesting for personal or confidential banking account information. Alert Maybank if you receive an email, letter or a telephone call requesting for personal or confidential banking account information.

Contact us at 1800‐MAYBANK (1800‐629 2265) or (65) 6533 5229 (Overseas) to verify the contents of the calls. Contact us at 1800‐MAYBANK (1800‐629 2265) or (65) 6533 5229 (Overseas) to verify the contents of the calls.

Relocation of Maybank@ChoaChuKang

Our current Maybank@ChoaChuKang branch will close on Saturday, 29 February 2020, at 12.15pm.

We look forward to connecting with you at our new Choa Chu Kang branch in May 2020, which will be located at Blk 304, Choa Chu Kang Ave 4, #01-661.

In the meantime, you may wish to visit any of our branches or your nearest branch at Maybank@JurongEast for your banking needs. |

| |

| |

| Download the new Maybank Mobile Banking app! |

|

|

| |

Heard about our new mobile banking app that's been redesigned with a focus on simplicity to meet your daily banking needs? Enjoy an enhanced banking experience on our new Maybank SG app now!

If you have not already downloaded the app, please do so before 16 March 2020 as the current Maybank SG app will no longer be available after that.

Find out more here. Download the Maybank2u SG app now! |

|

|

| |

| Bank 24/7 at our cash deposit machines |

|

|

|

Enjoy banking convenience 24/7 and minimise waiting at the branch when you deposit your notes at our cash deposit machines. Customers can drop off notes of any denomination including S$2 and S$5. Visit maybank.sg/locateus to find your nearest cash deposit machine. |

|

| |

| |

| Maybank Cares for Customers Affected by COVID-19 |

|

|

| |

Maybank Singapore is standing shoulder to shoulder with our customers whose livelihoods have been affected by the COVID-19 outbreak. To show our support for the community, we have introduced complimentary coverage by Etiqa Insurance Singapore for all individual Maybank customers, as well as Home Loan Repayment Relief.

(1) Complimentary COVID-19 and Dengue Fever Insurance Coverage for All Individual Maybank Customers

We have also pledged to provide a 30-day special insurance cover to all eligible customers of Maybank and Etiqa Singapore, free of charge.

The special coverage provides a lump sum S$3,000 Diagnosis Benefit if you are diagnosed with the Novel Coronavirus (COVID-19) or dengue fever. Your 30-day complimentary cover commences on the date of successful enrolment and will expire automatically on the 30th day of enrolment, or upon maximum payout. Enroll on Etiqa's website from 26 February till 20 March 2020. Click here to find out more.

(2) Home Loan Repayment Relief

Maybank is providing Home Loan Repayment Relief to existing customers whose income have been affected by the COVID-19 outbreak, allowing the deferment of the loan principal repayment for a period of 6 months. This means that you only need to pay the interest amount on your loan, thereby providing cash flow relief during this difficult period. To check your eligibility and make an application, please click here.

(3) Precautionary Measures for Branch Visits

At Maybank, your well-being and safety is our priority. In view of the current situation, we have stepped up the precautionary measures at our premises to ensure a safe environment for our customers and staff.

All visitors must undergo temperature screenings at all branches and Maybank premises. All visitors must undergo temperature screenings at all branches and Maybank premises.

All visitors are required to fill out a travel and health declaration form. Please note that your data is secure and will be collected for contact tracing purposes only. All visitors are required to fill out a travel and health declaration form. Please note that your data is secure and will be collected for contact tracing purposes only.

Customers are encouraged to make use of self-service banking facilities, online banking or the mobile banking app to do their banking securely whenever possible. Contact us at 1800-MAYBANK (1800-629 2265) or (65) 6533 5229 (Overseas) for assistance on our platforms.

Thank you for your understanding and co-operation. |

| |

|

| |

| HAPPENINGS |

|

| |

| Remit to Malaysia at attractive exchange rates |

|

|

|

Enjoy one of the most competitive MYR exchange rates when you remit to a Maybank Malaysia account!

Applicable for RegionLink Online Funds Transfer via Online Banking, Business Internet Banking and at Maybank branches. Terms and conditions apply.

Whether you are an individual or business banking customer, choose Maybank to take care of all your banking and payment needs. |

|

| |

| |

| Lunar New Year at Branches |

|

|

|

Maybank customers who visited our branches were delighted by staff with a festive Lunar New Year orange carrier bag, together with red packets and a pair of mandarin oranges for prosperity.

As part of our Lunar New Year giving efforts, Maybank partnered MINDS for the second year running to pack the festive bags, creating work opportunities for their clients. |

|

|

| |

|

| |

| Community Engagement |

|

| |

| Maybank supports Very Special Arts Singapore with funding to upskill artists |

|

|

|

Supporting employability is one of the key themes that Maybank supports to reduce social inequality. Maybank pledged a donation to Very Special Arts Singapore to fund the ALIVE (Arts for Livelihood and Employment) programme to upskill disabled artists and artisanal crafters. Dr John Lee, Country CEO and CEO of Maybank Singapore, presented the cheque to the patron of VSA Singapore, Professor Tommy Koh at the opening of The Gallery at Changi City Point on 18 January 2020.

One of the ALIVE participants Mr Lee Mun Choong went through funded training to hone his artistic talents, and was commissioned by Maybank to produce an artwork for a set of corporate coasters.

Dr John Lee said, "Maybank has had a long-standing relationship with Very Special Arts Singapore for the last 20 years. This new three-year partnership will allow VSA Singapore to identify gaps and provide practical training to help the artists to develop professionally. We hope more people will see their abilities beyond their disabilities."

Show your support and visit The Gallery by VSA Singapore!

Address: Changi City Point 5, Changi Business Park Central 1, #03-01 Singapore 486038

Opening Hours: Monday to Friday, 10am to 6pm |

|

| |

| |

| Championing social integration of persons with mental health conditions |

|

|

|

Maybank has been championing social integration and supporting the Institute of Mental Health (IMH) through its Global CR Day initiative since 2016.

In 2016, Maybank recognised the importance of patient rehabilitation and provided funds to seed IMH's first hydroponics garden to aid a patient therapy programme. Since then, the programme has benefitted over 30 patients. Let's work towards an inclusive and caring society.

Click here to watch the short film and hear from Maybank's volunteers and the IMH clients. |

|

| |

|

| |

| Humanising Finance |

|

| |

| Getting to know Structured Products |

|

|

|

Other than building a wealth portfolio that is heavily invested in cash or safe haven assets, a savvy investor might wish to consider equity-linked structured products which are yield-accretive and can help to weatherproof their portfolio. Humanising Finance speaks to the treasury products team at Maybank Group Wealth Management to understand the main features of structured products. |

|

| |

|

| |

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$75,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

This advertisement has not been reviewed by the Monetary Authority of Singapore. All information is updated at 1 March 2020. |

| |

|

| |

| Want the latest updates? |

|

| Follow us |

|

|