Before you begin investing, you can evaluate your risk appetite

with a risk profile questionnaire.

A risk profile

questionnaire helps assess your risk profile to determine what

type of investor you are so that you can determine the types of

investments that are suitable for you, and which ones to avoid

based on your willingness and capacity to tolerate risk.

Let's consider the following before you take the plunge to invest:

1. What is your investment

goal?

![]()

Different goals will need a different investment approach to be able to deliver the investment returns you seek to gain. For example, investing for your child's education fund over a 10-year horizon would involve a different strategy to planning for your retirement in 30 years' time.

2. How much time do you have?

![]()

After setting your sights on a goal, you will need to consider the time you have to invest (AKA your investing horizon). If you have 20 years to reach your goal, you may be able to take on higher risk to average out the losses and maximise the potential to make higher returns. However, if you only have 5 years, you may not have the time to wait for your investments to recover by the time you need the money.

3. How much risk can you live

with?

![]()

Imagine if you have 30 years ahead to manage your investments and have enough money set aside for emergencies and loan commitments. However, if the thought of losing money over your investment keeps you awake at night, then you should acknowledge that you are not comfortable with high risk investments.

Knowing your risk profile will help you assess your selection of

investments,

and here's how

Maybank Goal-Based Investment

on Maybank2u can help you. To know your risk profile, take a

simple quiz and see which of the below best describes you.

5 types of Risk Profiles

Your current risk profile is Type 1

Capital preservation is of primary importance to me. I am willing to accept investments with very low returns, in order to have minimal potential price fluctuation and potential losses in my investments.

Your current risk profile is Type 2

I prefer my investment return to be derived mainly from regular income along with some appreciation in asset value. I am willing to accept investments with low returns, in order to have low potential price fluctuation and potential losses in my investments.

Your current risk profile is Type 3

My investment goal is to achieve moderate levels of appreciation on my investments, and I prefer my returns to be derived from both regular income and appreciation in asset value. I am willing to accept investments with medium potential price fluctuation and potential losses.

Your current risk profile is Type 4

My investment goal is to achieve higher capital growth. I am prepared to accept investments with high potential price fluctuation and potential losses.

Your current risk profile is Type 5

My investment goal is to achieve the maximum possible return. I am prepared to accept investments with very high price fluctuation and potential losses, including the possibility of losing more than my original investment amount.

What's next:

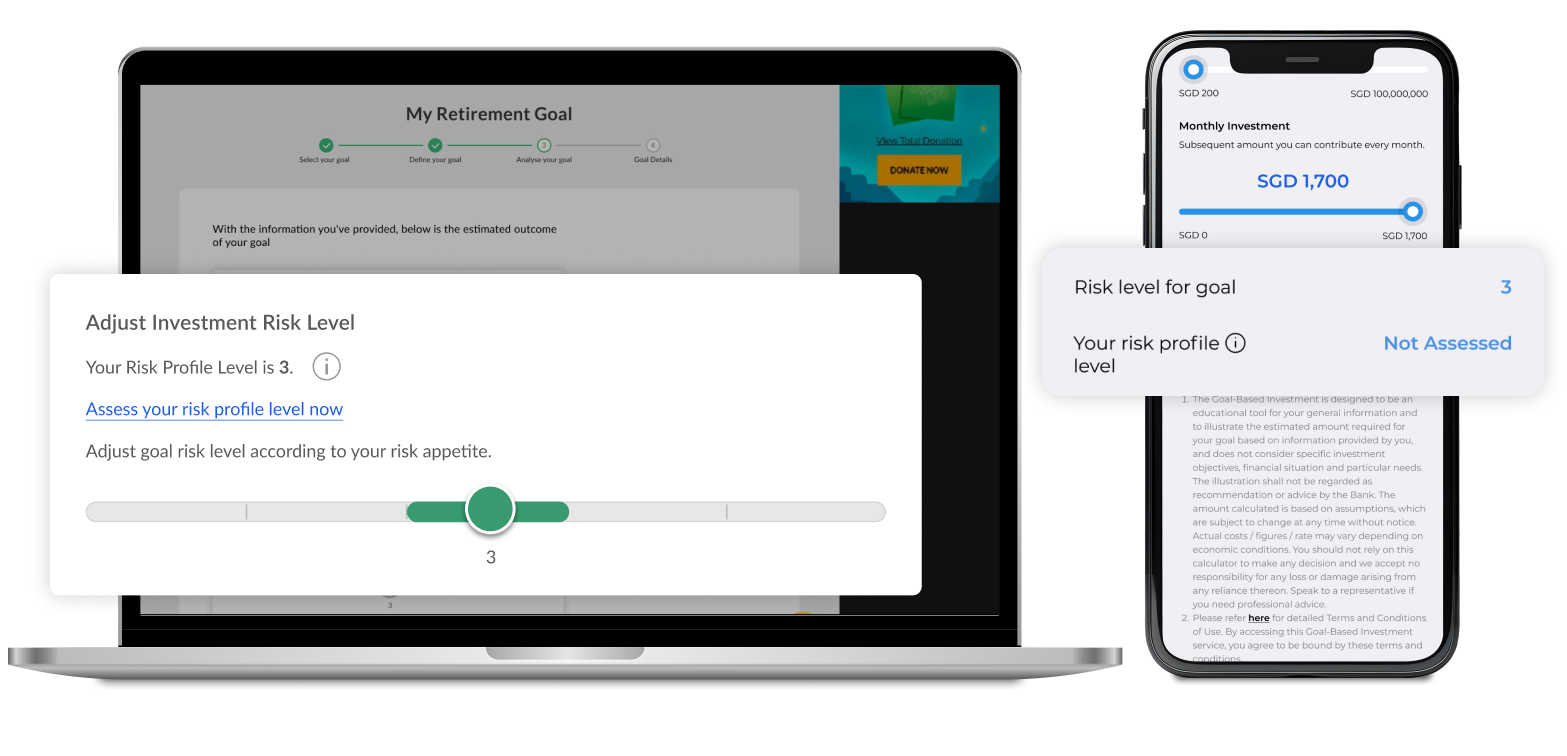

With a better understanding of your risk profile, you can get started with your first investment with Maybank Goal-Based Investment service which allows you to create and track investment goals, simulate investment outcomes and cultivate a habit of investing with automated monthly top-ups.

Depending on your risk profile, the simulator will recommend a suitable risk level for your goal, and shortlist Unit Trust funds that align to your overall investment needs. You can change your goal risk level or select funds with lower or higher risk rating. The simulator is only intended to kickstart your investment journey, your investment decision still lies with you.

Want to find out your Risk Profile?

You can easily estimate your risk profile with Maybank Goal-Based Investment.

Learn more about investing

Yes, I'm ready to invest.

*Disclaimer:

-

The Goal-Based Investment is designed to be an educational tool for your general information and to illustrate the estimated amount required for your goal based on information provided by you, and does not consider specific investment objectives, financial situation and particular needs. The illustration shall not be regarded as recommendation or advice by the Bank. The amount calculated is based on assumptions, which are subject to change at any time without notice. Actual costs / figures / rate may vary depending on economic conditions. You should not rely on this calculator to make any decision and we accept no responsibility for any loss or damage arising from any reliance thereon. Speak to a representative if you need professional advice.

-

The information contained herein is provided for general information only and subject to change without notice. Any views or opinions of third parties expressed in this material are solely those of the third parties and not of Maybank's.

-

Investors should note that returns from such Products, if any, may fluctuate and that each Product's price or value may rise or fall. Accordingly, investors may receive back less than what they have originally invested or they may also not receive back anything at all from what they have originally invested. All investments involve an element of risk, including capital and principal loss. Past performance is not necessarily a guide to or an indication of future performance.

For more information: