Wonder if Unit Trust is the right investment for you? Here is what you need to know before you invest.

What are Unit Trusts?

Unit Trust is a type of investment that is easily accessible and

affordable for those who are just starting out on their

investment journey. Unlike buying into a single company stock, a

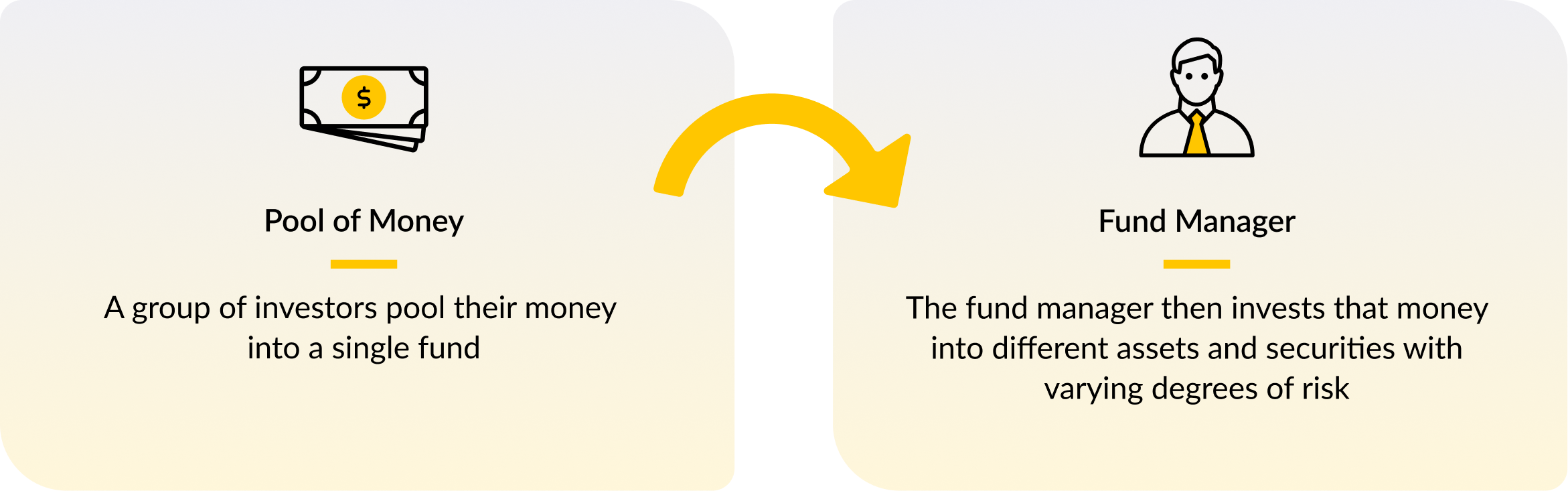

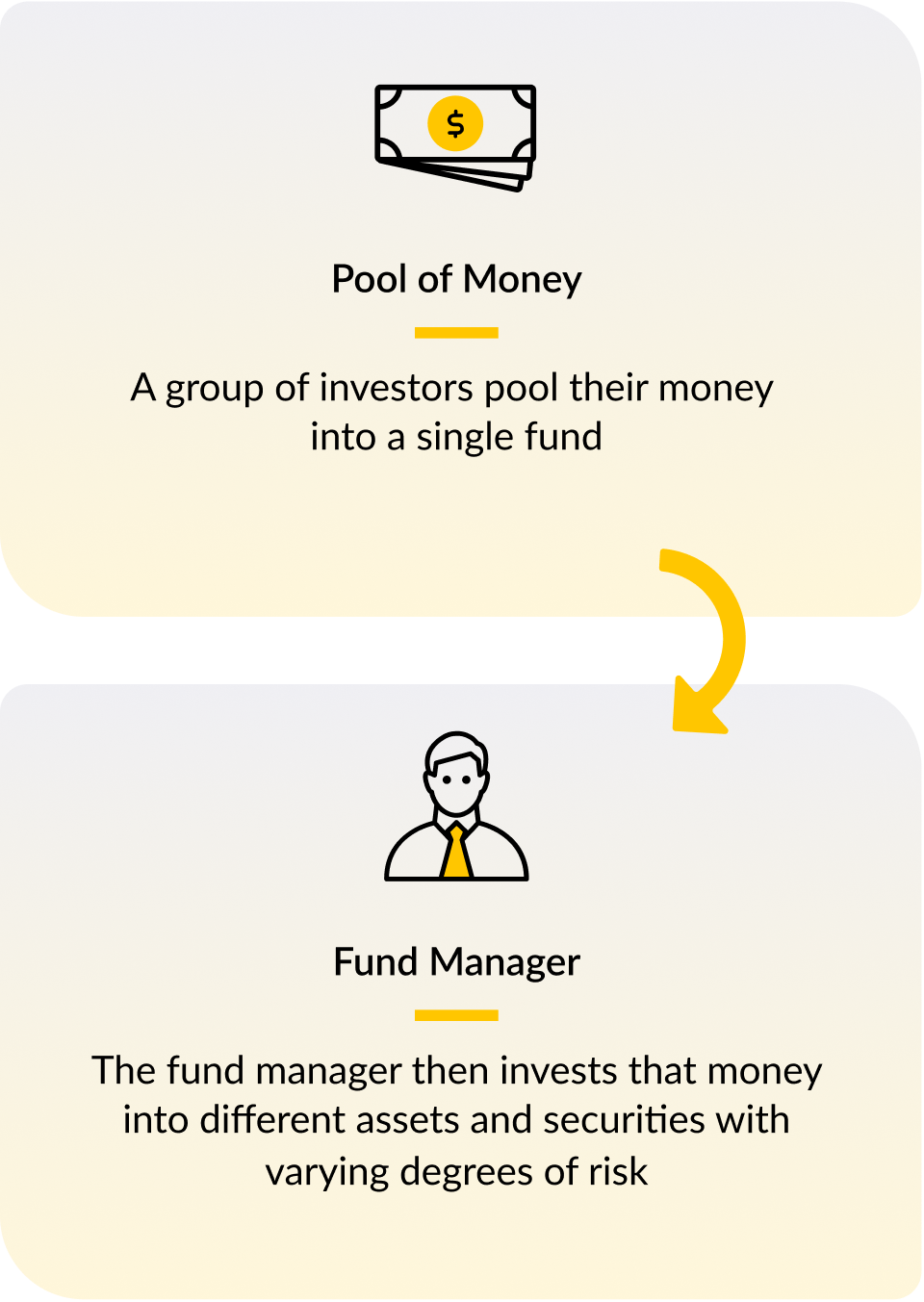

unit trust puts your money in the hands of a professional fund

manager who will pool your money together with other investors.

The fund manager then uses this pool of funds to invest in

various asset classes such as cash, bonds, shares, commodity and

so many more on the stock market on your behalf. This fund is

then split into smaller units that individual investors like you

and me can buy.

BlackRock, JPMorgan Asset Management and Lion Global Investors

Limited are some of the fund houses with Unit Trust offerings.

Learn more about fund houses

here.

What does Unit Trust invest in?

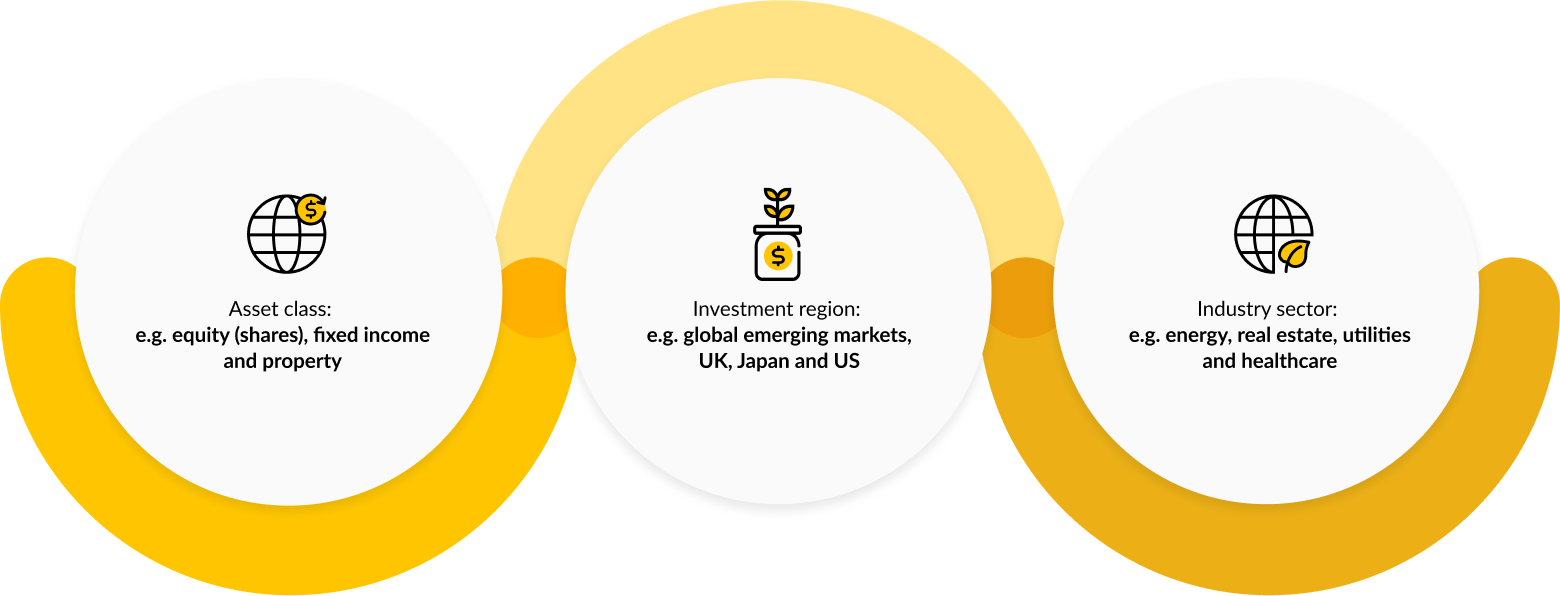

The fund manager will use the pool of funds to invest in various investments within a specific group of financial assets, which will then be put together as a Unit Trust Fund. The unit trust fund can then be further categorised based on region, asset classes and/or industry such as:

Unit Trust usually consists of the following asset classes:

Fixed Income

These consist of government securities and corporate bonds which can be local or global, issued by developed nations or emerging economies.

Equity or Stocks

These are riskier investments consisting of shares and other securities which you can buy an ownership interest, either local, regional or global.

Alternatives

Refer to less conventional investments like gold and REITs.

Cash

Liquid assets like bank deposits or currency you deposit in a bank account.

Is Unit Trust a high risk investment?

No investment is risk free, but you can diversify it. By

investing in a range of different asset classes, investment

regions, and industry sectors, fund managers can help investors

to diversify where their money is held to try and reduce risk.

You can also match your unit trust investments based on your

risk appetite. If you do not know your willingness and capacity

to take investment risk, find out by taking the Maybank

Goal-Based Investment

risk profile questionnaire

online.

As all investments carry risks, make sure you have considered the different risk factors you are willing to undertake prior to investing.

How can I grow my wealth through Unit Trust?

Like most “buy low, sell high” investment strategies, you make

money by selling your units for a higher price than when you

initially bought them. When you invest in unit trusts, you do

not actually own the assets in the unit trust fund that the fund

manager has invested in. Instead, you buy units of the fund

alongside many other investors. As the fund increases or

decreases in value, the value of each unit increases or

decreases accordingly.

As unit trusts are not usually considered short term

investments, a medium to long term unit trust investment (i.e. 3

to 20 years) would give investors much better returns than cash

savings and fixed deposits in the long run.

I'm pretty new to investing, should I still invest in Unit Trust?

As an amateur investor, you will need to put in a lot of time

and effort to maintain your portfolio of investments by keeping

up to date with market movements and world news to decipher how

each event will affect your investments.

Investing in unit trust transfers most of the necessary

'know-how' of investing to those best equipped to handle it -

the professional fund managers. The fund managers who are

entrusted to manage unit trust are experienced industry

professionals who have undergone the necessary training,

background and certifications to ensure that the investment

decision-making is structured and according to sound investment

principles.

If you're not that investment-savvy (yet), you can start out by

relying on the expertise of professional fund managers to manage

your unit trust investments for you.

Sounds great! But is it expensive for a fund manager to manage my funds for me?

There are a few different types of fees and charges to look out for when investing in unit trust. Do make sure you thoroughly research all the potential fees and charges before you begin investing.

Examples of fees and charges you may come across when investing in unit trusts:

Fees are usually charged as a percentage of your investment. So for example if you plan to invest S$1,000 in unit trust with a 1% upfront sales charge, you will need to fork out an additional S$10 when making a unit trust placement.

Sounds too complex?

Start small by investing online via

Maybank Goal-Based Investment. This service on Maybank2u allows you to invest in unit trust

and access fund managers' expertise at a low initial investment

amount of S$200. Easily create and track your investment goals,

simulate investment outcomes and cultivate the habit of

investing with automated monthly top-ups.

Begin your journey into unit trust investments today.

Learn more about investing

Yes, I'm ready to invest.

*Disclaimer:

-

The Goal-Based Investment is designed to be an educational tool for your general information and to illustrate the estimated amount required for your goal based on information provided by you, and does not consider specific investment objectives, financial situation and particular needs. The illustration shall not be regarded as recommendation or advice by the Bank. The amount calculated is based on assumptions, which are subject to change at any time without notice. Actual costs / figures / rate may vary depending on economic conditions. You should not rely on this calculator to make any decision and we accept no responsibility for any loss or damage arising from any reliance thereon. Speak to a representative if you need professional advice.

-

The information contained herein is provided for general information only and subject to change without notice. Any views or opinions of third parties expressed in this material are solely those of the third parties and not of Maybank's.

-

Investors should note that returns from such Products, if any, may fluctuate and that each Product's price or value may rise or fall. Accordingly, investors may receive back less than what they have originally invested or they may also not receive back anything at all from what they have originally invested. All investments involve an element of risk, including capital and principal loss. Past performance is not necessarily a guide to or an indication of future performance.

For more information: