Scenario

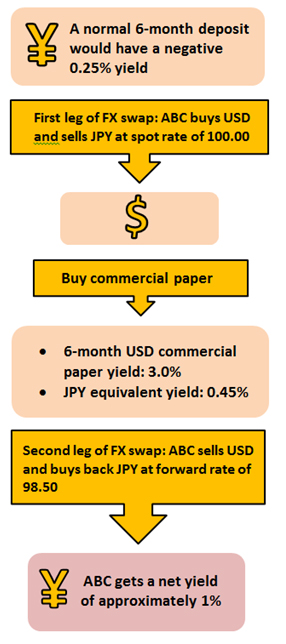

ABC Company has a negative-yield deposit in Japanese currency (JPY). ABC wants to avoid the effects of negative interest, but it is required to hold onto the JPY and cannot sell it.

Our Solutions

With Maybank's help, ABC plans to swap JPY to USD, and to use the USD to buy commercial papers.

1. ABC enters into a 6-month JPY currency swap linked to XYZ Bank's commercial papers.

2. ABC uses the USD from the swap to buy XYZ Bank’s 6-month commercial paper, holding the credit risk of the commercial paper's issuer.

3. At the end of 6 months, ABC sells the commercial papers and swap the currency back to JPY as the predetermined rates.

4. In the process, ABC didn't hold any foreign exchange risk. By using this method, ABC gets a net yield of 1% versus a -0.25% yield if it held only the JPY throughout the 6 months.