To live the life we aspire to lead, we need to be in control of our finances. When we have accounts in different banks, government agencies, SGX Central Depository (CDP) and insurance with different insurers, things can get a bit overwhelming.

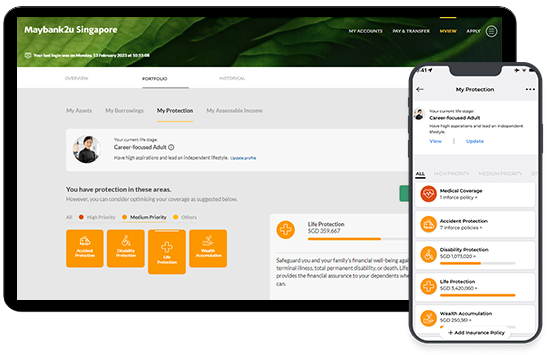

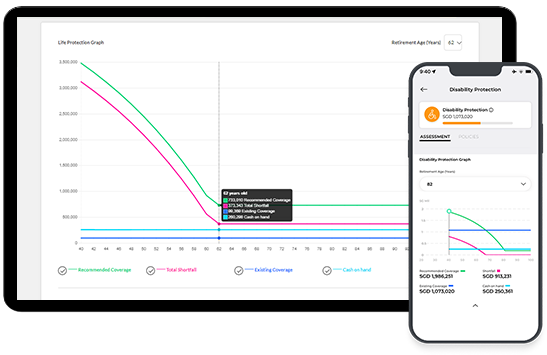

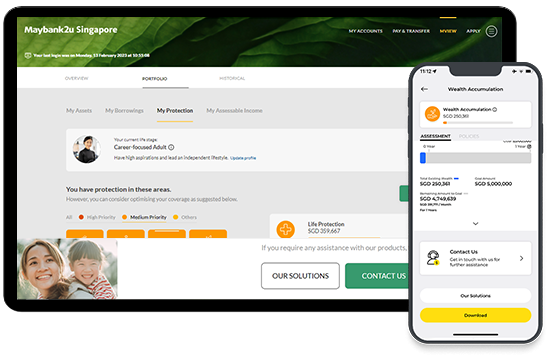

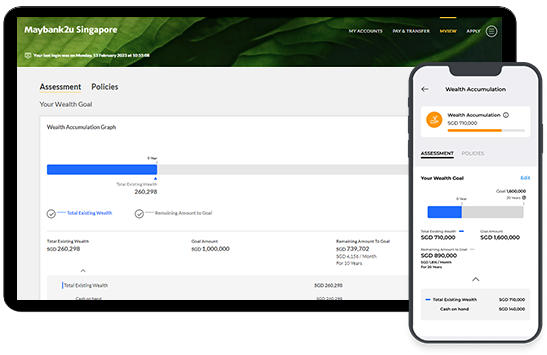

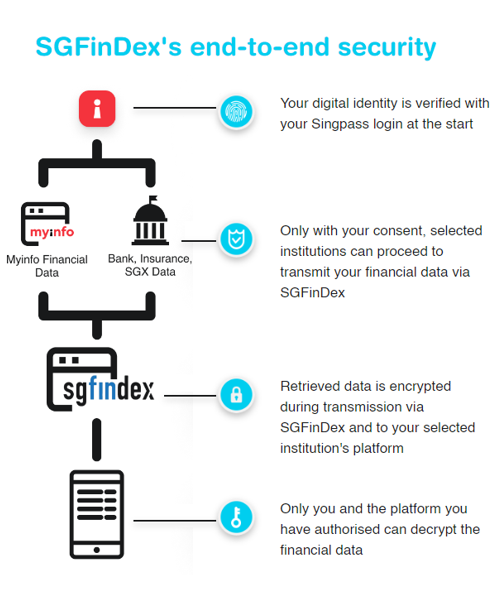

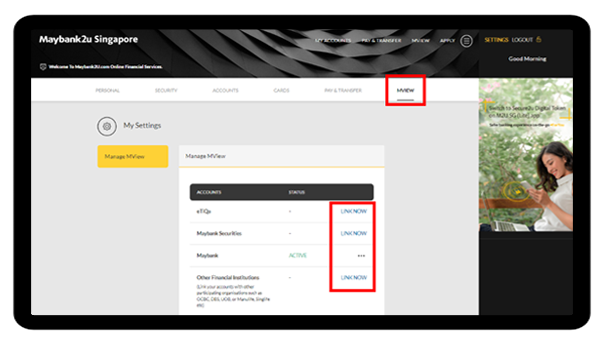

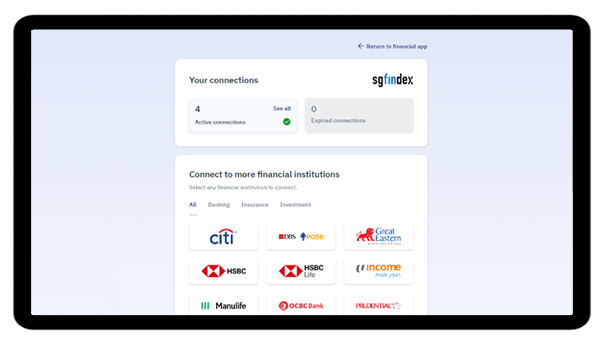

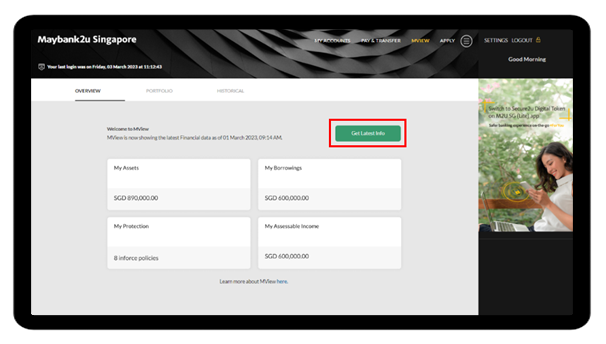

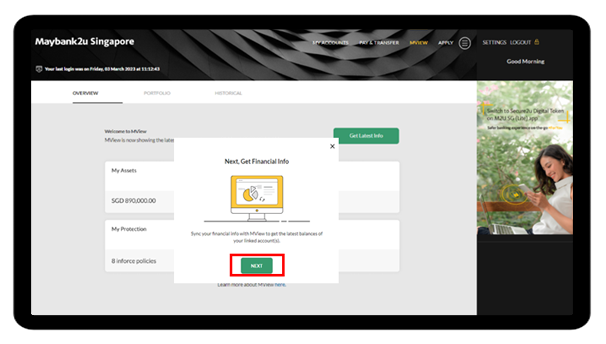

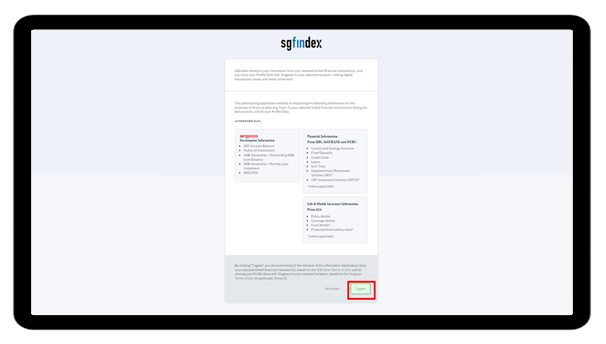

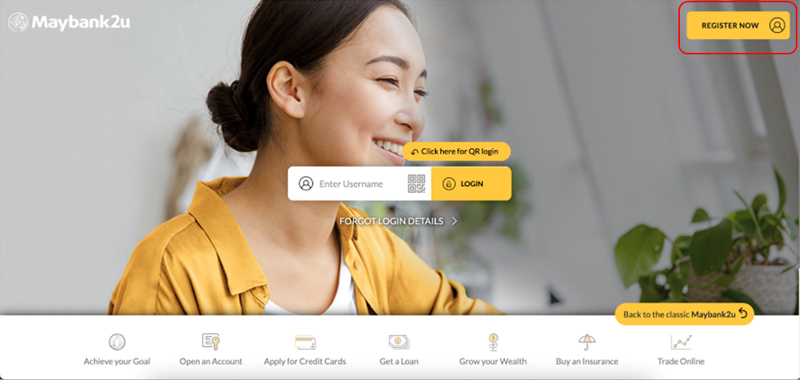

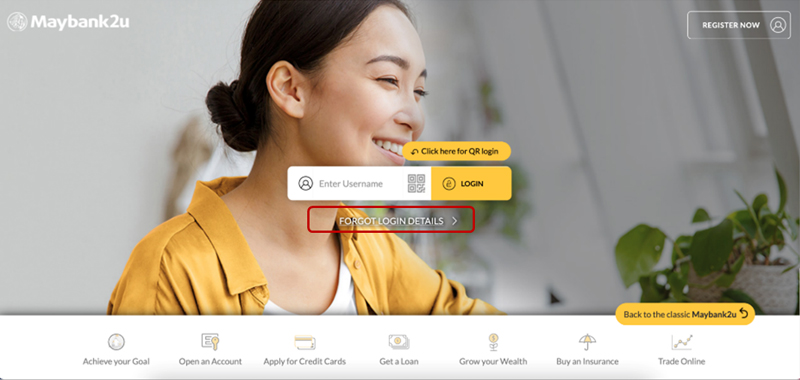

That’s why Maybank built MView. Powered by Singapore Financial Data Exchange (SGFinDex), it is a new feature on Maybank2u SG (Lite) app and Maybank2u Online Banking #ForYou. You can now securely consolidate your assets, borrowings and insurance policies across participating banks, government agencies and insurers, and view them all in one place.

Watch this video to find out more about MView:

No more toggling between different apps and websites or using a spreadsheet to consolidate your finances. With Maybank MView, you can see the big picture of your financial health. Make smarter financial decisions by linking your account today!

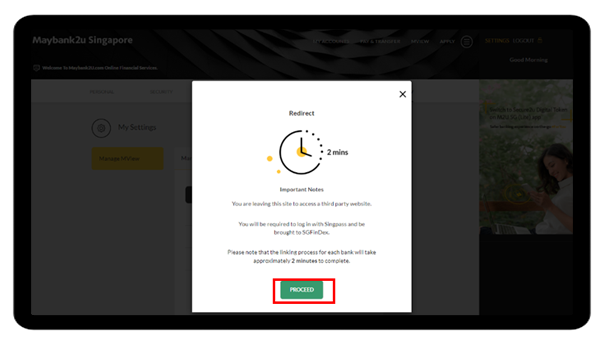

If you have not linked any participating organisations, click on “LINK NOW” to begin. If you have linked with other participating organisations, click on “LINK NOW” to refresh your data.