Foreign Exchange Risk

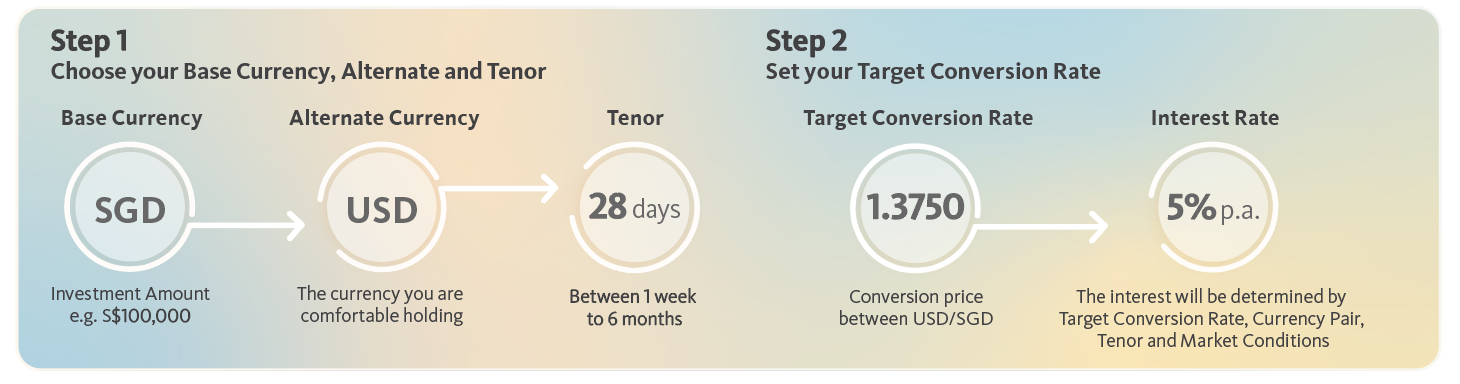

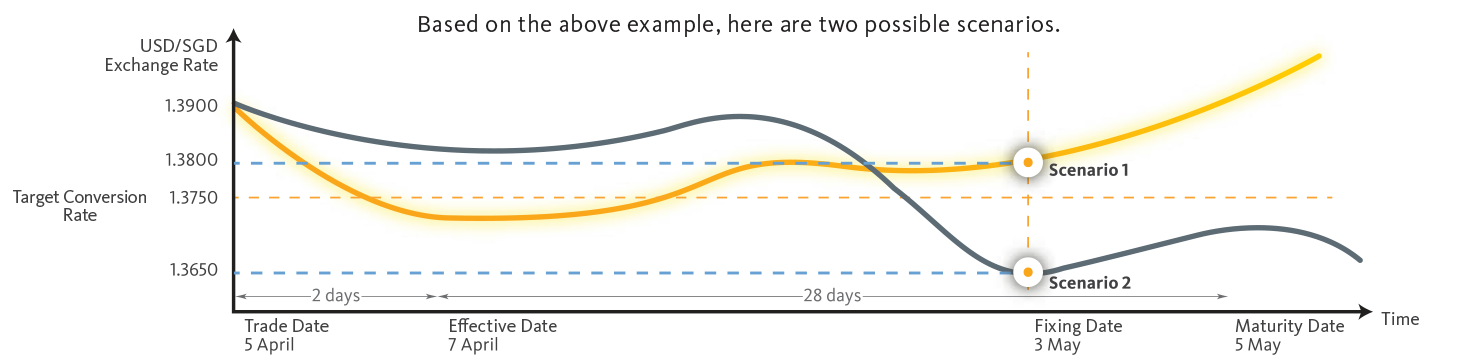

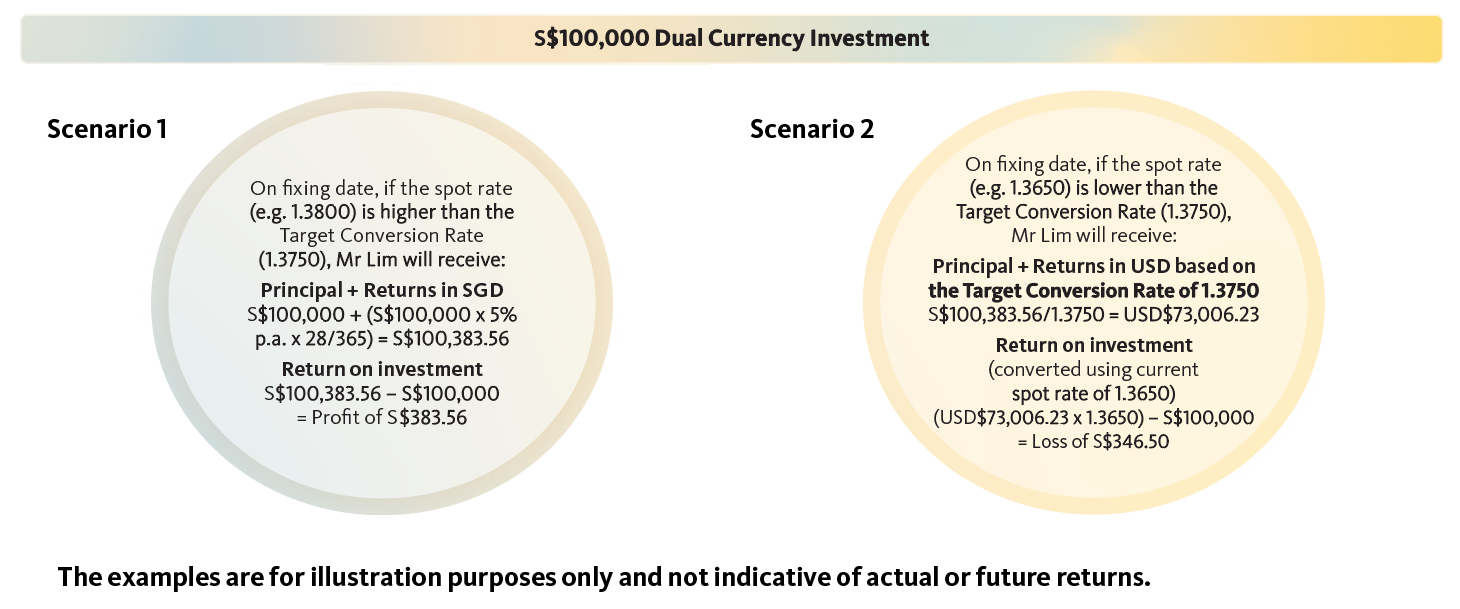

Dual Currency Investment is not an ordinary time deposit or foreign currency deposit but an investment product embedded with a currency option. The Bank has the right to repay the investor at maturity date either in the base currency or in a specified alternate currency at a conversion rate agreed at the time the Dual Currency Investment was made. The Dual Currency Investment is an investment product described as “principal-at-risk”. The actual return of the investment may be negative in the event the base currency is paid in the alternate currency.

Early withdrawal/early termination

As provided in the Terms and Conditions of the Dual Currency Investment, an early withdrawal or early termination of the Dual Currency Investment may also result in a lower rate of return for the investor or a loss of the initial base principal amount invested/deposited. The Bank may, in its sole discretion, deduct additional costs, losses or expenses incurred in relation to such early withdrawal or early termination (including without limitation, any break cost, administrative cost, cost of unwinding any hedge being put in place, cost of funding or loss of bargain).

Cancellation of investment

In the event the investor requests to cancel the Dual Currency Investment before the investment amount has been debited from the investor’s account or fails or neglects to place the investment amount on trade date, the Bank shall have the right to cancel the Dual Currency Investment and charge all costs and expenses incurred arising from the aforementioned failure or neglect (the “Cancellation Cost”). The calculation by the Bank of any Cancellation Cost shall be conclusive and binding on the investor save on manifest error. The investor hereby agrees and authorises Maybank to debit their account for any Cancellation Cost, after which the instruction for the Dual Currency Investment will be deemed terminated with immediate effect.

Non-principal protection

Dual Currency Investment does not have principal protection and the principal amount of the investment is NOT guaranteed.

Non-insured deposit

A Dual Currency Investment is not an insured deposit for the purposes of the Deposit Insurance and Policy Owners’ Protection Schemes Act 2011 (Act 15 of 2011 ).

Warning: By purchasing the Dual Currency Investment, you are giving the issuer of this product the right to repay you at a future date in an alternate currency that is different from the currency in which your initial investment was made, regardless of whether you wish to be repaid in this currency at that time.

Dual Currency Investments are subject to foreign exchange fluctuations, which may affect the returns of your investment. Exchange controls may also be applicable to the currencies your investment is linked to.

You may incur a loss on your principal sum in comparison with the base amount initially invested. You may wish to seek advice from a licensed or an exempt financial adviser before making a commitment to purchase this product. In the event that you choose not to seek advice from a licensed or an exempt financial adviser, you should carefully consider whether this product is suitable for you.

This brochure does not purport to identify all the risks which may be associated with Dual Currency Investments.

This brochure is prepared by Maybank for information purposes and should not be construed as an offer to sell, recommend or solicit the purchase of any investment product, enter into any transaction or adopt any investment strategy. Maybank makes no representation and/or warranty as to the accuracy or completeness of this information and is not liable for any errors or omissions herein, nor shall it be liable for any losses arising out of any person's reliance upon this information. This statement is not intended to provide personal investment advice and no consideration has been given to the particular investment objectives, financial situation or particular needs of any recipient. Investors should therefore rely on their own judgment and/or seek financial, legal and other advice in making their investment decisions. Any information contained herein is subject to change at any time, without prior notice.

This advertisement has not been reviewed by the Monetary Authority of Singapore.