- Enhance your investment with multiple bonus units

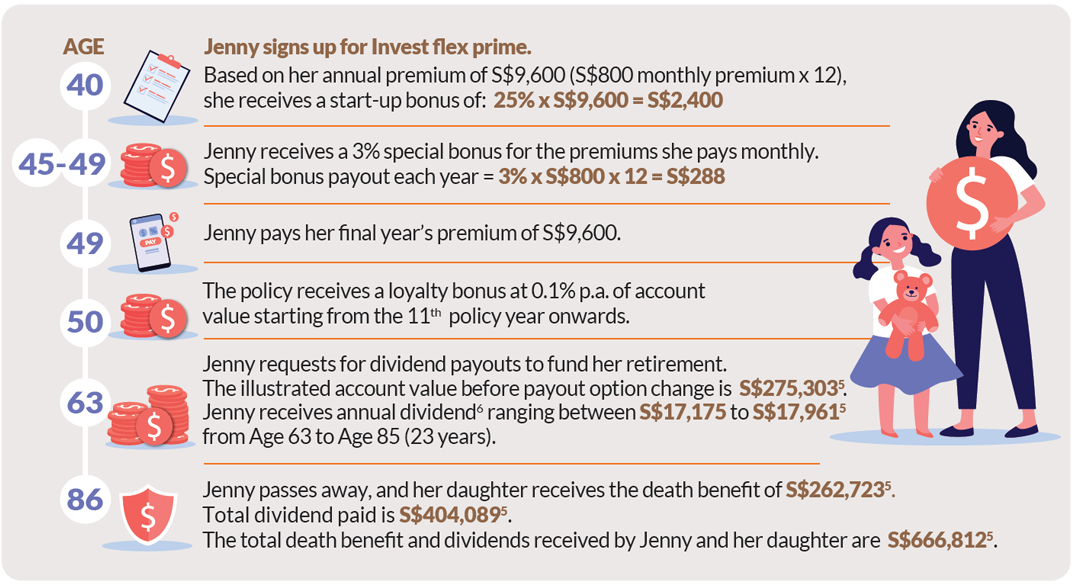

- Accelerate your returns with a start-up bonus of up to 55%1 in your first year of investment.

- Enjoy a 3% special bonus of regular premium paid from as early as your 6th policy year2 onwards.

- Stay committed to your investment goals and receive a loyalty bonus of 0.1% p.a. of your account value at the end of your premium payment term.

- Flexibility to match your evolving goals and needs

- Choose your premium term between 10 Years – Flexi 3, 10 Years – Flexi 5, 15 Years and 20 Years.

- Take a break from premium payments without incurring charges while your policy continues to grow with our premium-free period benefit3.

- Access your funds while keeping your policy in force with 2 free partial withdrawals from your 4th policy year in times of need.

- Increase your investment value with the option to top-up your premiums.

- Protect your loved ones from life’s uncertainties

- Be covered against death and terminal illness at the higher of 101% of total premiums paid4 or regular premium account value.

- Protect your investment in tough times with our premium waiver. If the life insured is diagnosed with a severe-stage critical illness, Extra secure waiver II covers premiums for the basic plan and rider up to age 85 or the end of the premium term, whichever is earlier.

1For policy with 20 Years premium term. Start-up bonus varies by premium term, please refer to the policy contract for more details.

2For policy with 10 Years – Flexi 5 premium term. For other premium term, please refer to the policy contract for more details.

3Please refer to the policy contract for more details.

4Upon the death of the Life insured while the Policy is in force, the death benefit payable is the sum of:

- 101% of (total regular Premium paid less all partial withdrawals made from the Regular Premium Account) or the Regular Premium Account value, whichever is higher; and

- Top-up Account value, less any amounts owing to us.