Comprehensive CI coverage for multiple stages

Get protection against 104 medical conditions across early, intermediate and major stages.

Lump Sum Payout for all stages of CI4

- Early and Intermediate Stage CI Benefit

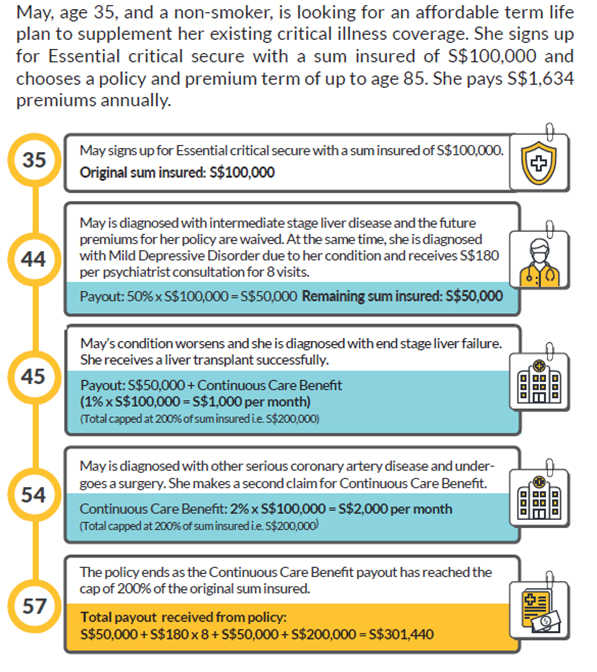

50% of the sum insured will be accelerated and paid upon the diagnosis of a covered early or intermediate stage CI.

- Severe Stage CI Benefit

Receive 100%5 of the sum insured upon the diagnosis of a covered severe stage CI.

Continuous Care Benefit First in market!

Additional monthly cash payout of 1% of the sum insured upon the diagnosis of any of the 36 covered severe stage CIs for up to 200%1 of the original sum insured.

Be assured to receive at least 5 years of Continuous Care Benefit once a successful claim is made, even if the policy ends or death happens.

Premium Waiver Benefit

Secure peace of mind with all future premiums waived upon the diagnosis of a covered early or intermediate stage CI.

Financial support for mental health

- Mild Mental Health Benefit

Payout of S$180 for each psychiatrist consultation (up to 8 claims) upon the diagnosis of Mild Depression or Generalised Anxiety Disorder after the first policy year. - Severe Mental Health Benefit

If the life insured is diagnosed with 1 of the 5 covered severe mental health conditions, 20% of the sum insured will be accelerated6 and paid in one lump sum.

Flexible coverage duration

Choose from a coverage term of up to age 70, 75, 80, 85, 90, 95 and 100, whichever best suits your needs.

Death benefit

A lump sum of S$5,000 will be paid to your loved ones should the unforeseen happen.

1 Subject to a maximum of 2 claims. The total amount payable for the Continuous Care Benefit does not exceed 200% of the original sum insured per policy.

2 Original sum insured means the sum insured of the Essential critical secure policy before the reduction in sum insured due to prior claim(s) for CI Benefit and Severe Mental Health Benefit.

3 Premium is illustrated based on a female aged 1 year, non-smoker and a sum insured of S$100,000 for a premium and policy term of up to age 70 on a yearly premium frequency.

4 CI Benefit consists of the Early and Intermediate Stage CI Benefit and the Severe Stage CI Benefit. The total amount payable for CI Benefit does not exceed 100% of the sum insured. Maximum aggregate amount of S$2,000,000 per life insured for early, intermediate and severe stages of CI (including premiums to be waived under this policy), subject to a cap of S$350,000 per life insured for early or intermediate stages of CI, for all policies and riders issued by us and other insurance companies on the same life insured.

5 Except for Angioplasty and Other Invasive Treatment for Coronary Artery. Less any claim(s) paid for Angioplasty and Other Invasive Treatment for Coronary Artery, Early and Intermediate Stage CI Benefit and Severe Mental Health Benefit.

6 Subject to a maximum of S$25,000 per life insured.