- Competitive interest rates and exchange rates

- Round-the-clock service with Online and Mobile Banking

- 5 major currencies available, i.e. AUD, EUR, NZD, GBP and USD

- Choice of 1, 2, 3 and 6 months tenure for 5 major currencies and 12 months for USD

Time Deposits

iSAVvy Foreign Currency Time Deposit

Expand your investment portfolio with a wide range of currency options, and earn preferential interest and exchange rates.

How to Place Deposit

If you are an existing Maybank customer, you can conveniently place a Time Deposit via:

Maybank2u Online Banking

Step 1: Log in, select Apply >Time Deposit

Step 2: Select the Time Deposit account type, enter Principal amount and choose Transfer From (account) to debit funds for this placement

Step 3: Select Tenure > Maturity Instructions

Step 4: Decide if you wish to lock your TD account

Step 5: Agree to confirm the placement

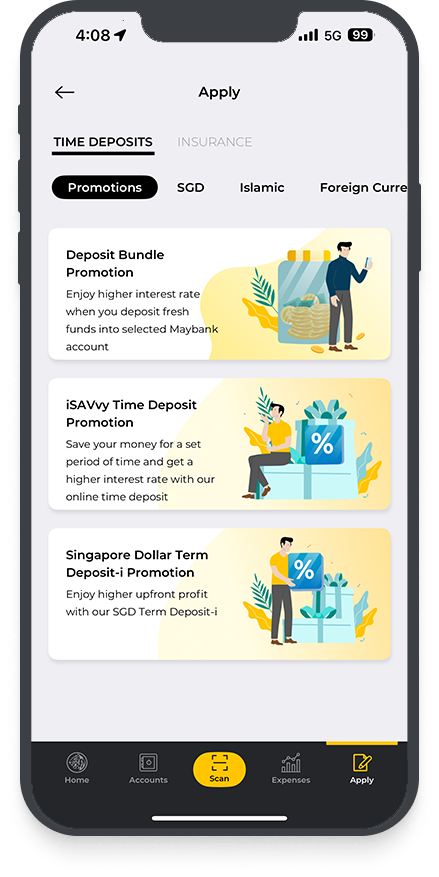

Maybank2u SG app

Step 1: Log in, select More (at bottom right) > Apply >Time Deposit

Step 2: Select the Time Deposit account type, enter Principal amount and choose Transfer From (account) to debit funds for this placement

Step 3: Select Tenure > Maturity Instructions

Step 4: Decide if you wish to lock your TD account

Step 5: Agree to confirm the placement

You must have a Maybank Savings or Current Account and Maybank2u Online/Mobile Banking access to make the placement online.

Don’t have a Maybank Savings Account? Apply for one online, now.

Eligibility

- Minimum age: 18 years old

- Initial deposit:

- 10,000 units for all foreign currencies

- Maintain any Maybank Savings or Current account with Maybank2u Online Banking access

- Foreign Currency Time Deposit principal will be debited from this account

- Interest and principal upon deposit maturity will be credited to this account

Fees and Charges

Click here to view other applicable Bank charges for our services.

Useful Links

- Terms and Conditions Governing Foreign Currency Time Deposit Accounts (PDF)

- Terms and Conditions Governing Money Lock (PDF)

- Calculator

Important information

The iSAVvy Foreign Currency Time Deposit is a deposit account that can only be operated via Maybank2u.com.sg. No statement or advice will be issued. Premature withdrawal (whether partial or in full) and top-up of the principal amount is not permitted. The Bank may however in its discretion, allow a premature withdrawal in full upon it being compensated for all losses arising from such premature withdrawal, including the replacement cost for such deposit. Such premature withdrawal and any change in Maturity Instruction can only be made at least 2 business days in advance, at any of our Maybank Branch in Singapore