Discontinuation of 36-Month Maybank Singapore Dollar Time Deposit Placements

Effective 25 April 2025, we will cease new placements of 36-month Singapore Dollar Time Deposits / Term Deposit-i.

Terms and Conditions apply.

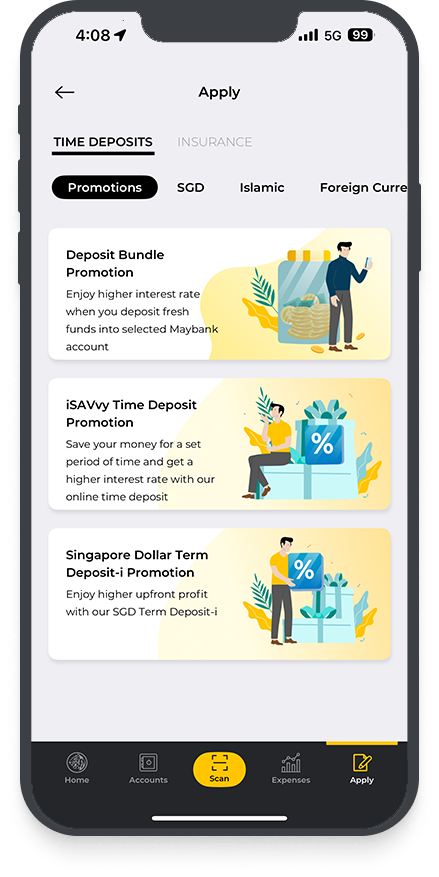

Time Deposits

Maybank Privilege Plus Time Deposit

Effective 25 April 2025, we will cease new placements of 36-month Singapore Dollar Time Deposits / Term Deposit-i.

Terms and Conditions apply.

Enjoy attractive interest rate of up to 2.45% p.a. with our SGD Time Deposit.

Terms and Conditions apply.

If you are a Singaporean or Permanent Resident, you may place a Time Deposit via any of the methods below:

Step 1: Apply Now

Click “Retrieve Myinfo with Singpass”. Please have your Singpass ID and password ready.

Step 2: Verify / complete your personal details and select the Time Deposit you wish to open. Follow the on-screen instruction to complete your Time Deposit placement.

For existing Maybank customers

Step 1: Download the Maybank2u SG app and login with your online banking username and password

Step 2: Tap on ‘More’ > ‘Apply’.

For new customers

Step 1: Download the Maybank2u SG app and tap on ‘More’ > ‘Apply’.

Step 2: Select the Time Deposit you wish to open, and apply via Singpass if you are a Singaporean or Permanent Resident.

You must have a Maybank Savings or Current Account and Maybank2u Online/Mobile Banking access to make the placement online.

Don’t have a Maybank Savings Account? Apply for one online, now.

Receive your interest from one of the arrangements below when you place your deposit for a minimum of 12 months:

Documents Requirement for Singapore Citizens or Permanent Residents

Documents Requirement for Foreigners (original physical documents required):

| Description | Fees and Charges |

|---|---|

|

Others |

Click here to view other applicable Bank charges for our services |

^The option to receive the monthly interest is applicable to tenures of at least 12 months and above. The interest will be credited into your Maybank Privilege Plus Savings Account.

Premature withdrawal of less than 3 months - No interest will be paid

Premature withdrawal of more than 3 months - The interest is pro-rated based on the number of days the Time Deposit is placed, calculated on the lowest tier of the prevailing Savings Account rate at time of withdrawal or the contracted rate, whichever is lower.