- Potential bonus in hibah may be distributed at the Bank’s discretion to customers who save regularly. If declared, this bonus will be credited on the first calendar day, after the end of each 12-month period, starting from the second calendar month of account opening.

- 24-hour service with Maybank2u Online and Mobile Banking.

- Withdraw cash at no charge at all Maybank ATMs and atm5 network in Singapore.

- Convenience of paying with NETS and FlashPay with your Maybank Platinum Debit Card.

- Lock your savings in Money Lock for greater peace of mind

Islamic Deposits

A journey of a thousand miles begins with a single step

Maybank Ar Rihla Regular Savings Account-i

-

Features

Save with ease and spiritual clarity with as little as S$50 a month.

Requirements

ELIGIBILITY:

- Age: 16 and above. Individuals below 16 may open a Trust Account in the name of the parent or legal guardian.

APPLICATION DOCUMENTS:

Singapore Citizens or Permanent Residents

- Online account opening

- Via Myinfo

Foreigners

- Online account opening

- Via MyinfoNEW

- At the branch

- Passport

- Valid pass (e.g. Employment Pass (EP) or S-Pass or Student Pass)

- Proof of Mailing Address (i.e. Utility/Telco bills or Bank statement from another bank in Singapore, where the name must be the same as your Passport and Employment Pass)

DEPOSIT REQUIREMENT:

Singapore Citizens or Permanent Residents

- Initial deposit for Online account opening: S$200

- Initial deposit at the branch: S$10

Foreigners

- Initial deposit at the branch: S$500

How to Apply

Available to Singapore citizens, Singapore Permanent Residents, FIN-holders* and Maybank Malaysia customers

Online application via Myinfo

Step 1: Apply Now

Click under Myinfo Please have your Singpass ID and password ready.

Step 2: Receive Account Number

- You will receive an email with your new account number in a password protected PDF file upon submission of the application

- A password will be sent via SMS to the mobile number indicated on the application form to open the PDF file

If you are not our existing Online Banking Customer, you will receive:

- Online Banking Access ID in the PDF file

- Another SMS which contains your PIN to sign-up or perform a First Time Login to Online Banking

*FIN-holders refer to holders of Employment Pass, S-Pass, Long-term Social Visit Pass and Student Pass.

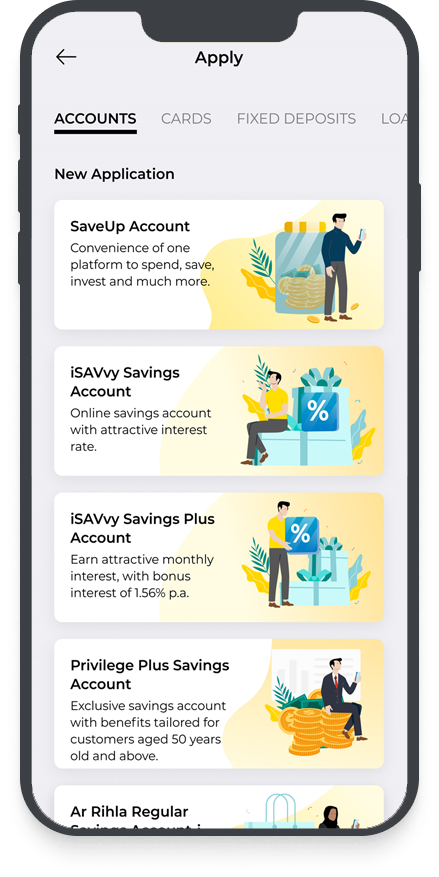

Application via Maybank2u SG app

For existing Maybank customers

Step 1: Download the Maybank2u SG app and login with your online banking username and password

Step 2: Tap on ‘More’ > ‘Apply’.

For new customers

Step 1: Download the Maybank2u SG app and tap on ‘More’ > ‘Apply’.

Step 2: Select on the account you wish to open, and apply via Singpass if you are a Singaporean or Singaporean PR. Alternatively, you can apply via M2U Malaysia if you are a Maybank Malaysia customer.

Apply at the Branch (with original physical documents):

- Passport

- Valid pass (e.g. Employment Pass (EP) or S-Pass or Student Pass)

- Proof of Residential Address (i.e. Utility/Telco bills or Bank statement from another bank in Singapore, where the name must be the same as your Passport and Employment Pass)

Fees & Charges

Please click here to view the other Bank charges applicable for our services

Secure2u Digital Token

To access your account balances on Maybank2u Online and Mobile banking, you are required to register for Secure2u Digital Token to authenticate logins and transaction. Download the Maybank2u SG app to set up your Digital Token today.

Important Information

Note for accounts opened online:

- Monthly paper statements will be received instead of passbook.

- The fixed monthly savings amount will be set at the minimum of S$50.

- To revise the fixed monthly savings amount, please visit any Maybank branch after your account has been opened.

- Terms and Conditions Governing Savings Account (PDF)

- Ar Rihla Regular Savings Account-i FAQ

- Hibah Rates

- Maybank Shariah Committee Members