- Competitive profit rates and exchange rates.

- 24-hour service with Maybank2u Online & Mobile Banking.

- Choice of 1, 2, 3 and 6 months tenure for all currencies and 12 months for AUD, GBP, NZD and USD.

- Access to overdraft facilities secured against your deposit.

Islamic Deposits

Diversify your financial portfolio with foreign currencies

Maybank Foreign Currency Term Deposit-i

How to Place Deposit

If you are an existing Maybank customer, you can conveniently place a Time Deposit via:

Maybank2u Online Banking

Step 1: Log in, select Apply >Time Deposit

Step 2: Select the Time Deposit account type, enter Principal amount and choose Transfer From (account) to debit funds for this placement

Step 3: Select Tenure > Maturity Instructions

Step 4: Decide if you wish to lock your TD account

Step 5: Agree to confirm the placement

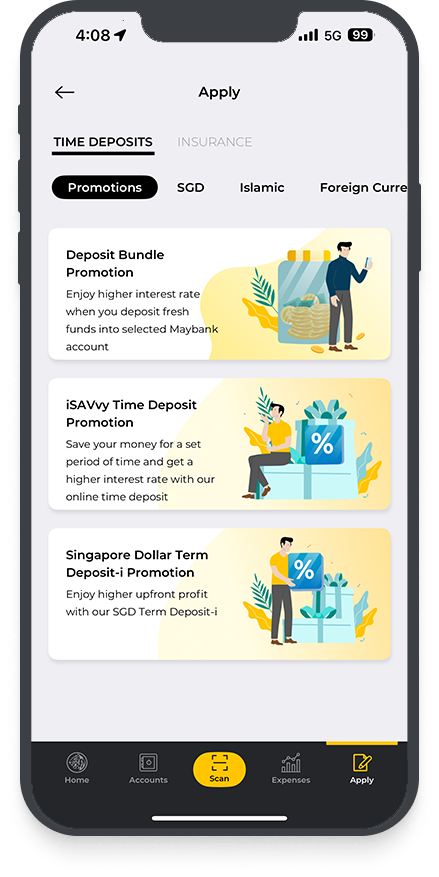

Maybank2u SG app

Step 1: Log in, select More (at bottom right) > Apply >Time Deposit

Step 2: Select the Time Deposit account type, enter Principal amount and choose Transfer From (account) to debit funds for this placement

Step 3: Select Tenure > Maturity Instructions

Step 4: Decide if you wish to lock your TD account

Step 5: Agree to confirm the placement

You must have a Maybank Savings or Current Account and Maybank2u Online/Mobile Banking access to make the placement online.

Don’t have a Maybank Savings Account? Apply for one online, now.

Requirements

ELIGIBILITY:

- Age: 18 and above.

MINIMUM DEPOSIT:

- 10,000 units for all foreign currencies

DOCUMENTS REQUIRED FOR PLACEMENT AT THE BRANCH:

Singapore Citizens or Singapore Permanent Residents

- NRIC

Foreigners

- Passport

- Employment Pass

- Proof of mailing address i.e. utilities bill or bank statement with residential address, where the name must be the same as your Passport and Employment Pass

Fees & Charges

| Description | Fees and Charges |

|---|---|

| Others | Click here to view other applicable Bank charges for our services |