Time Deposit Promotions

Enjoy attractive interest rate of up to 1.55% p.a. with our SGD Time Deposit.

Terms and Conditions apply.

Time Deposits

Maybank Singapore Dollar Time Deposit

Enjoy attractive interest rate of up to 1.55% p.a. with our SGD Time Deposit.

Terms and Conditions apply.

If you are a Singaporean or Permanent Resident, you may place a Time Deposit via any of the methods below:

Step 1: Apply Now

Click “Retrieve Myinfo with Singpass”. Please have your Singpass ID and password ready.

Step 2: Verify / complete your personal details and select the Time Deposit you wish to open. Follow the on-screen instruction to complete your Time Deposit placement.

For existing Maybank customers

Step 1: Download the Maybank2u SG app and login with your online banking username and password.

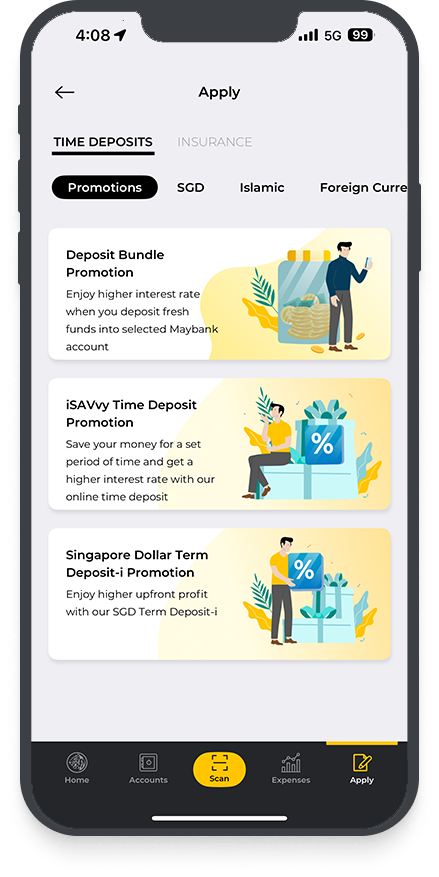

Step 2: Tap on ‘Apply’ > ‘Time Deposits’, and select the Time Deposit you wish to open.

For new customers

Step 1: Download the Maybank2u SG app and tap on ‘Apply’ > ‘Time Deposits’.

Step 2: Select the Time Deposit you wish to open, and apply via Singpass if you are a Singaporean or Permanent Resident.

You must have a Maybank Savings or Current Account and Maybank2u Online/Mobile Banking access to make the placement online.

Don’t have a Maybank Savings Account? Apply for one online, now.

Documents Requirement for Singapore Citizens or Permanent Residents

Documents Requirement for Foreigners (original physical documents required):

| Description | Fees and Charges |

|---|---|

|

Others |

Click here to view other applicable Bank charges for our services |