Unfold travel experiences

beyond your horizons

Credit Card

Unfold travel experiences beyond your horizon and experience MORE in every way with up to 2.8 air miles on air tickets, foreign spend, hotel bookings and more, with one of the best air miles credit cards

Maximise your travel rewards!

2.8 miles (7X TREATS Points)¹ on all air ticket purchases² and foreign spend – online and in-person with S$800³ monthly spend

1.2 miles (3X TREATS Points)¹ on all travel-related expenses, including travel & cruise packages, online travel bookings, retail purchases (both online and in-person), groceries, and more—no minimum spend required!

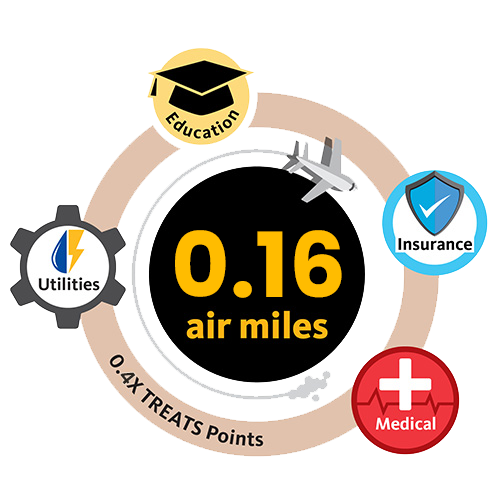

Earn additional miles when you spend on Insurance, Medical, Utilities, Education, Rentals and more.

¹2.8 and 1.2 air miles are applicable only if redemption is made on Maybank TREATS SG app.

²Bonus TREATS Points (TP) awarded for air tickets will be capped at 40,000 TP for each calendar month.

³If the monthly accumulated spend is less than S$800, 1.2 air miles (3X TREATS Points) will be awarded for air tickets and foreign spend

Simply consolidate all your expenses on your Card to earn 27,000 KrisFlyer Miles, good for a return trip to Bangkok.

| Expenses | Earn Rate | TPs Earned | |

|---|---|---|---|

| Shopping | S$500 | 3X | 1,500 TP |

| Groceries | S$400 | 3X | 1,200 TP |

| Dining | S$550 | 3X | 1,650 TP |

| Food Delivery | S$350 | 3X | 1,050 TP |

| Hotel Bookings | S$1,100 | 3X | 3,300 TP |

| Air Tickets | S$800 | 7X | 5,600 TP |

| Foreign Spend | S$7,600 | 7X | 53,200 TP |

|

Total |

S$11,300 | 67,500 TP |

Above table is for illustrative purposes only.

ONLY APPLICABLE FOR NEW TO BANK CARD APPLICANTS

Receive a Samsonite ENOW Spinner 69/25 (worth S$570) when you apply for a new Maybank Credit Card and charge a minimum of S$1,300 within the first two months of card approval.

Alternatively, you may apply for CreditAble and a new Maybank Credit Card, and charge a minimum of S$1,200 within the first two months of card approval.

If you are a Maybank Privilege customer, apply for the Maybank Privilege Horizon Visa Signature Card here.

Get ready your Singpass account and retrieve data via Myinfo to complete your application instantly:

Please fill in the form and upload the required documents:

Singpass is a data platform that pulls your personal data from participating Government agencies to fill out e-forms.

Singpass holders can use Singpass to retrieve personal information from participating Government agencies. Singpass is temporarily unavailable from 2 am to 8.30 am every Wednesday and Sunday. Find out more.

Your newly approved Credit Card account(s) will come with Online Banking and eStatements+. To view your eStatement, please sign-up via Maybank Online Banking (maybank2u.com.sg) and perform a first time login.

+Auto enrolment for eStatement is not applicable for Maybank CreditAble.

Terms and Conditions apply.

Enjoy 20.05% + 3X TREATS Points when you link your Diamond Sky Fuel Card to your Maybank Horizon Visa Signature Card

Travel in comfort at selected VIP airport lounges when you charge a minimum of S$1,000 on your travel expenses within 3 months prior to the date of lounge use.

Receive complimentary travel insurance coverage of up to S$1,000,000 when you charge your travel fares in full to your Maybank Horizon Visa Signature Card.

Plus, enjoy other card privileges too:

Up to 18% off flight bookings with Firefly

Up to 10% off bookings with Emirates

Up to 10% off bookings with Malaysia Airlines

Up to 7% off hotel and flight bookings worldwide with Trip.com

IDR8,000 off when you book your Grab Rides in Indonesia

Up to 20% off activities with Klook

Terms and Condition apply.

Unlock instant rewards with Maybank TREATS SG app, a lifestyle and loyalty mobile app that offers exclusive and rewarding benefits and privileges in an instant. Make instant redemptions at participating merchants, enjoy deals up to 50% off, eCoupons, freebies and much more.

Download the mobile app and allow notifications to receive news on exclusive deals.

2 ways to download the Maybank TREATS SG app:

Go to App Store or Google Play and search for TREATS SG

Scan the QR code

Redeem rewards all year round with your TREATS Points (TP) on the Maybank TREATS SG App! We have curated a collection of privileges and lifestyle indulgences from dining and shopping, to travel & leisure.

Terms and Condition apply.

Make contactless payments easily with your Maybank Cards through your mobile devices

Activate magnetic strip for overseas use via our app or online banking

Share access with a supplementary card

Or refer friends for S$80 cashback per successful referral

Principal Card: S$196.20* (inclusive of GST), waived for first 3 years

Supplementary Card: Free

*Subsequent annual fee will be automatically waived with a minimum spend of S$18,000 yearly

Click here for other credit card fees and charges.

Singaporean/PR

Foreigners

¹ Print your Income Tax Notice of Assessment at myTax Portal using your Singpass or IRAS PIN.

² You can print your latest 12 months CPF Contribution History Statement using your Singpass via https://www.cpf.gov.sg/members. If your monthly income exceeds S$6,800 (Effective 1st January 2025: S$7,400), submit your latest Income Tax Notice of Assessment or computerised payslip instead, for proper maximum credit limit calculations.

Please allow 7 business days for processing, and application is subject to approval. Note that incomplete forms or missing documents will delay processing. The Bank reserves the right to request for more documents. Should the income documents you submit reflect a lower earned income than what was previously declared, the bank reserves the right to adjust the current credit limit to reflect the prevailing earned income.

Maybank Horizon Platinum Visa Cardmembers enjoy a different suite of Card benefits and privileges.