Available to Singapore citizens, Singapore Permanent Residents, FIN-holders* and Maybank Malaysia customers

Online application via Myinfo

Step 1: Apply Now

APPLY ONLINE NOW

Click under Myinfo Please have your Singpass ID and password ready.

Step 2: Receive Account Number

- You will receive an email with your new account number in a password protected PDF file upon submission of the application

- A password will be sent via SMS to the mobile number indicated on the application form to open the PDF file

If you are not our existing Online Banking Customer, you will receive:

- Online Banking Access ID in the PDF file

- Another SMS which contains your PIN to sign-up or perform a First Time Login to Online Banking

*FIN-holders refer to holders of Employment Pass, S-Pass, Long-term Social Visit Pass and Student Pass.

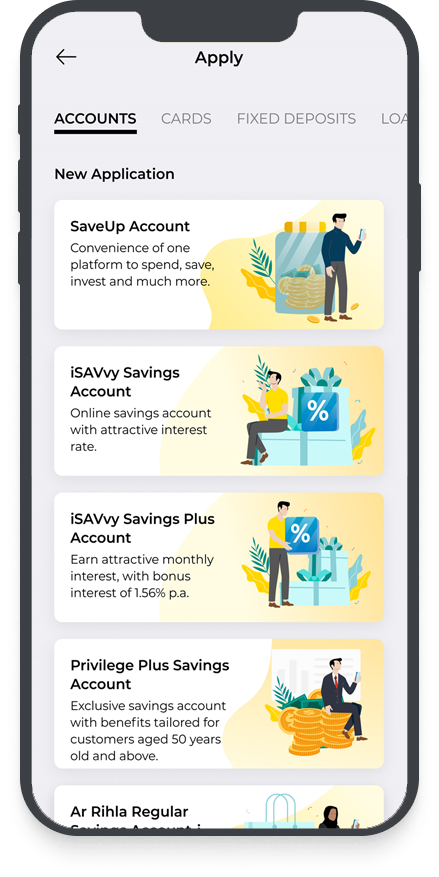

Application via Maybank2u SG app

For existing Maybank customers

Step 1: Download the Maybank2u SG app and login with your online banking username and password

Step 2: Tap on ‘More’ > ‘Apply’.

For new customers

Step 1: Download the Maybank2u SG app and tap on ‘More’ > ‘Apply’.

Step 2: Select on the account you wish to open, and apply via Singpass if you are a Singaporean or Singaporean PR. Alternatively, you can apply via M2U Malaysia if you are a Maybank Malaysia customer.

Download now

Apply at the Branch (with original physical documents):

- Passport

- Valid pass (e.g. Employment Pass (EP) or S-Pass or Student Pass)

- Proof of Residential Address (i.e. Utility/Telco bills or Bank statement from another bank in Singapore, where the name must be the same as your Passport and Employment Pass)